Current Price: $564 Price Target: Increasing to $660 from $540

Position Size: 3.7% TTM Performance: +38%

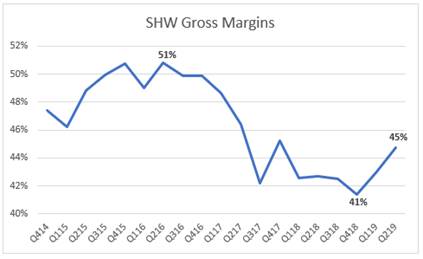

SHW beat on revenue and EPS and increased the midpoint of guidance (implies +14% YoY EPS growth). The America’s group again had impressive paint stores SSS performance of +8%. Gross margins continue to improve as recent pricing actions are gaining traction to offset raw material inflation. Performance in the quarter was driven by continued strength in North American architectural paint markets, which offset choppiness in some industrial end markets. Management talked positively about housing market strength – despite headline miss reported today in existing home sales which were down sequentially, but still up YoY.

Key Takeaways:

· SHW is benefitting from higher product prices, good volume growth, falling raw material costs and an improvement in housing.

· Margins increased in all 3 segments.

· They continue to see some softness internationally and strength in the US.

· The Americas Group: 55% of sales, +8.7%

o SSS of +8%, an acceleration from +4.3% last quarter.

o Generated strong growth in all regions and all customer end markets, led by double digit growth in residential repaint.

o Opened 31 net new stores year to date.

o Professional painting contractor customers continue to report strong demand.

· Consumer Brands Group: 16% of sales, -12%

o The decrease in the quarter was due to softer sales outside of North America, lapping load-in sales for a new customer program in 2018 and the divestiture of the Guardsman furniture protection business.

o In North America, we continued to strengthen our relationships with our largest retail partners.

o FX headwinds(-1.3%)

· Performance Coatings Group: 29% of sales, -0.3%

o Soft sales outside North America and unfavorable currency translation. FX headwinds(-1.6%)

o The segment was impacted by slowing industrial demand in some end markets, leading to slightly lower sales in the quarter.

o Despite the softer than expected top line, with moderating raw material costs margins increased YoY.

o Revenue growth strongest in coil and packaging.

Valuation:

- Expected free cash flow of ~$2.2B in 2020, trading at >4% FCF yield.

- Given growth prospects, steady FCF margins and high ROIC the stock is undervalued. They deserve a premium multiple based on large exposure to the N. American paint contractor market and lack of exposure to the cyclical sensitive auto OEM end market.

- Balance sheet leverage from the Valspar acquisition continues to improve; they expect to get to under 3x by the end of the year.

· Refinanced and extended the maturity of their debt, locking in lower rates.

· Share buybacks should increase in 2020 as they get their leverage ratio down to 2-3x.

Thesis:

- SHW is the largest supplier of architectural coatings in the US. Sherwin-Williams has the leading market share among professional painters, who value brand, quality, and store proximity far more than their consumer (do-it-yourself) counterparts.

- Their acquisition of Valspar creates a more diversified product portfolio, greater geographic reach, and is expected to be accretive to margins and EPS. The combined company is a premier global paint and coatings provider.

- SHW is a high-quality materials company leveraged to the U.S. housing market. Current macro and business factors are supportive of demand:

- High/growing U.S. home equity values. Home equity supportive of renovations.

- Improving household formation rates off trough levels (aging millennials).

- Baby boomers increasingly preferring to hire professionals vs. DIY.

- Solid job gains and low mortgage rates support homeownership.

- Residential repainting makes up two thirds of paint volume. Homeowners view repainting as a low-cost, high-return way of increasing the value of their home, especially before putting it on the market.

$SHW.US

[tag SHW]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109