Key Takeaways:

Current price: $127 Price target: $138

Position size: 2.96% 1-year performance: +28%

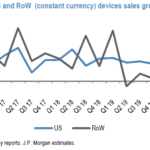

Resmed released impressive global masks sales growth of 19%, most likely grabbing additional market shares. Total sales were +16% (ex-FX), or +11% organic. The management team highlighted positive conditions in all its major markets in Q1 (new product launches, expansion of resupply programs), but we should expect some deceleration going forward, as competitors are launching new products as well, and year-over-year comparison numbers become harder to beat. Devices sales were +8% in the US, gaining market shares in this segment as well, as the digital connected care is gaining traction. Sales were up “only” 4% in the rest of the world, as RMD had tough comparisons y/y.

Gross margin expanded thanks to recent acquisitions, better product mix and some pricing. With strong sales, the company is seeing some nice operating leverage.

We believe the software business the company has been expanding this past few years will provide continued growth for the company, growing from high single digits in Q1 to double digits into fiscal year end.

Overall it was a pretty nice quarter for the company, supportive of our thesis on the name.

Thesis on RMD:

- Leading position in the underpenetrated sleep apnea space

- Duopoly market

- New product cycle

- Returns of capital to increase: ~1% share buyback/year (back in FY18), dividend yield of 2%

$RMD.US

[tag RMD]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109