BEXIX – Q3 2019 Commentary

Overview:

The Baron Emerging Markets Strategy Portfolio outperformed its benchmark during the quarter and YTD. Outperformance was mostly driven by stock selection, and also driven by allocation in the financials sector.

Market Overview:

– U.S.-China issues continue to create uncertainty in the market, even though central banks are acting to accommodate growth, especially in EM

– Additional tariffs on $300b of Chinese goods sparked an escalation back in August – U.S. felt that China failed to honor commitment to purchase soybeans

§ Tension calmed in October when the U.S. and China met to negotiate terms, yet uncertainty is still contributing to recession fears

– Despite geopolitical troubles, several pockets of EM have shown promise and strong performance

§ Brazil: Social security and fiscal reforms; privatization has enhanced sovereign credit profile; reduced inflation expectations and interest rates have boosted earnings expectations

§ India: while economic and credit growth have weakened, policy initiatives have been introduced by President Modi with expectations to stabilize the economy and bring growth potential through large corporate tax cuts

– EM equities underperformed U.S. and global indexes, mostly due to unclear geopolitical and trade outlook

Performance Review:

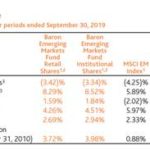

– BEXIX was down 3.34% in Q3 2019, yet still outperformed its benchmark (MSCI EM Index) by 91bps

– Stock selection in Indian and Brazilian markets helped lead absolute returns

§ Unexpected tax cuts by President Modi aided this performance in India

– Communications services, industrials, and healthcare also brought relative strong performance, but this was offset by adverse stock selection in the energy sector (Argentina and Taiwan in specific)

§ Argentina’s adverse surprise in the initial round of presidential election strong detracted from relative performance

– Stock selection in information technology also modestly detracted from returns

– 5 new investments, while exiting 16 – deliberate due to the escalation of the U.S.-China trade war

§ Turnover modestly exceeds historical levels

§ Looking to reduce total number of positions by eliminating smaller positions and adding to higher conviction long-term investments

– Top 3 contributors

§ Taiwan semiconductor manufacturing company (0.37%): global semiconductor demand went positive due to 5G investments in telecommunications equipment and smartphones

§ Pagseguro digital (0.34%): strong momentum in key performance indicators

§ PT tower Bersama infrastructure (0.21%): in-line second quarter results with slight increase in expectations for year

– Top 3 detractors

§ YPF S.A. (-0.42%): opposing candidate won primary elections by surprisingly large margin

§ Sasol limited (-0.31%): company announced further delays for chemical plant project in U.S.

§ Tencent holdings limited (-0.28%): second quarter revenue growth fell short of expectations and gross margin compressed

Market Outlook:

– Fund can invest in any market cap

§ Large/giant cap: 76%; mid cap: 20%; small/micro cap: 0.5%

– While global environments remain volatile, managers of BEXIX believe there will be a trade deal in the next 3-6 months

§ Extending tariffs will harm the U.S. more than China

§ Further restrictions on flow of high-technology goods will cause material disruptions across the global technology sector

§ As election nears, President Trump will look to solidify Midwestern vote (through large soybean purchase commitment from China)

§ A year into China’s broad stimulus campaign, negative economic surprised affect the U.S. more than China

– Upon a deal announcement, managers of BEXIX are predicting benefit to EM economies, currencies, and equities in the short-term

– Over the long-term, these managers believe the U.S dollar is coming to a peak, ultimately leaving EM at a trough with large upside potential

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109