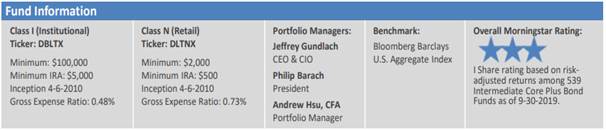

DBLTX – Q3 2019 Commentary

Overview:

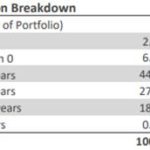

The DoubleLine Total Return Bond Fund underperformed its benchmark during the quarter, as well as YTD. This underperformance was heavily driven by the shorter duration of the Fund compared to its benchmark, as we saw 2-year and 10-year rates decline 13bps and 34bps, respectively.

Market Overview:

– During 2019, long-duration bonds brought higher returns as international tariffs and uncertainty continued

– Regardless of the Fed and ECB easing, the Agg returned 2.3% for the quarter

§ 25bps reduction in July, 25bps reduction in September, 25bps reduction in October

– The S&P 500 total return was 1.7% during Q3 2019, yet large differences existed between sectors

§ YTD, the S&P 500 is up over 20%, gaining almost 3.5% in October

§ Utilities were up the most at 9.3% for the quarter, while Energy was down 6.2%

– U.S. equities and fixed income markets have outpaced the returns of both developed and emerging markets

§ Barclays Agg up 8.5% YTD

§ Investment grade corporates up 3.1% for quarter, 13.2% YTD

– The Fed is not planning on raising rates until inflation reaches a consistent level of 2%

Performance Review:

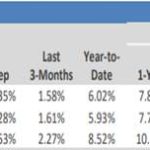

– In Q3 2019, DBLTX underperformed the Barclays U.S. Agg Index by 69bps

§ DBLTX returned 1.58%, while the Agg returned 2.27%

– YTD, DBLTX underperformed the benchmark (Barclays Agg) by 250bps, mainly due to the shorter duration of DBLTX

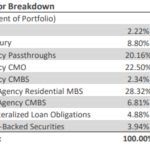

– All sectors within DBLTX had positive total returns for the quarter

§ Agency & Non-Agency MBS contributed the most to returns

– Agency MBS held a longer duration which helped its returns as rates dropped

– Non-Agency returns were mainly due to interest distributions from pre-crisis mortgage loans

– CLOs & ABS had the lowest performance due to these sectors having shorter durations

– Underperformance can also be attributed to investment grade corporate bonds’ outperformance compared to the Agency, Non-Agency MBS, and ABS markets

Market Outlook:

– Majority consensus believes that another 25bps rate cut will occur prior to year-end (as measured by Bloomberg’s WIRP)

– For the first time since 2009 the Fed stepped in to provide liquidity to the market through quantitative easing, bringing up mid-duration yields which caused the yield curve to steepen

– Slowdown in manufacturing data globally, yet not data is signaling a weakening economy

§ Non-manufacturing within the U.S. continued to expand

§ Business activity and new orders remain robust

§ The U.S. labor market and consumers are helping to keep economic growth consistent

– Both positives and negatives weighed on Q3 which does not appear to go away in the near future

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109