HILIX – Q3 2019 Commentary

Overview:

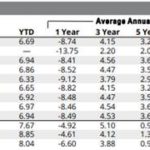

The Hartford International Value Fund performed in line with its benchmark during the quarter, but underperformed YTD. Slow global growth, geopolitical tensions, and monetary stimulus by central banks are key factors that have led to negative returns during the quarter.

Market Overview:

– U.S. Fed and European Central Bank working to stimulate monetary front

§ 25bps reduction in July, 25bps reduction in September, 25bps reduction in October in an effort to continue economic expansion

§ ECB unveiled a long-term economic stimulus package to help economy, which included an open-ended asset purchase program and relatively favorable bank lending conditions

– The MSCI All Country World ex-USA index rose for third straight quarter

– A freeze on fuel prices by Argentinian government could impact earnings in region

§ Argentine stocks already fell in August due to pro-business President Mauricio Macri being setback in primary election

Performance Review:

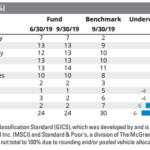

– Holdings of materials, information technology, and industrials contributed the most to performance

– Communication service and consumer discretionary detracted and offset relative returns

– Sector allocation, which was overweight to materials and information technology and underweights to the utilities sector, detracted from relative performance

– Geographically, Hong Kong, Australia, and Canada contributed the most, while France, Italy, and Germany lagged

– Style continued to be a headwind

§ Value underperformed

§ Even with extreme relative style valuations, HILIX will continue to focus on opportunities that focus on stocks with low relative price, low expectations, and low valuations (featuring strong balance sheets and significant potential upside)

– Top contributor

§ Surgutneftegas (Russia): state-owned oil and gas company

– Top detractor

§ YPF (Argentina): energy company

– New positions

§ Mitsubishi motors (Japan)

§ Deutsche Lufthansa (Germany)

Market Outlook:

– Global growth, geopolitical tensions, monetary easing all factors contributing to a volatile and struggling market

– Boris Johnson appointed as the new prime minister of the U.K. after winning the Conservative Party contest

– Antigovernment protests in Hong Kong significantly affected the country’s economy

§ Private sector hit worst downturn since global financial crisis

– Challenging cyclical factors likely to continue through 2020, yet the demography, fundamentals, valuations, consumer, economy of EM make for a compelling reason to invest in this market and wait for potential large returns

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109