LISIX – Q3 2019 Commentary

Overview:

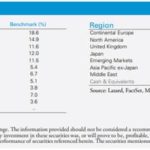

The Lazard International Strategic Equity Portfolio underperformed its benchmark during the quarter, yet outperformed YTD. Quarterly underperformance can be partially attributed to disappointing earnings from companies located in Europe, Hong Kong, and China.

Market Overview:

– International equities fell slightly in Q3 2019

§ Continued weak macroeconomic data and bullish corporate commentaries point to slowing activity

§ Tariffs between China and U.S. and disputes between Japan and South Korea further pressured negative sentiment

§ Bond yields dropped in the U.S. and sunk to new lows (even negatives) in other markets

– Markets saw struggles from cyclical sectors and strengths from defensive sectors

§ Energy and financials came out weak

§ Consumer staple and healthcare

– September saw a reversal in this trend, though, possibly due to spread between growth and value

Performance Review:

– Positive results helped spur growth for LISIX

§ Suncor (Canada): energy

§ Safran (France): aerospace

§ TMX (India): financial systems

§ Medtronic (U.S.): medical devices

§ Daiwa House (Japan): construction

– Negative earnings detracted returns and growth for LISIX

§ Makita (Japan): power tools

§ CAE (Canada): pilot training

§ Diageo (England): alcohol

§ Sampo (Finland): insurance

§ Prudential (England): insurance

§ AIA (Sri Lanka): insurance

§ Nexon (Japan): gaming

– Overall, stock selection in energy, real estate, and industrials sectors helped LISIX, while stock selection in materials, communication services, consumer staples, and financials sectors hurt the fund

Market Outlook:

– Slowing macroeconomic data and escalations of trade war between U.S. and China will likely have negative short and long-term consequences for global growth

– Monetary easing by the Fed continues, but it is unclear if this approach will be enough to settle economic volatility

§ Stable businesses trading at high valuations backed by low interest rates

§ Cyclical businesses lower returns and short-term economic pressure are trading at increasingly low valuations

– Through focused stock selection to find stocks with sustainable returns at attractive valuations, the team believes LISIX will be able to maintain strong long-term returns

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109