WATFX – Q3 2019 Commentary

Overview:

The Western Asset Core Bond Fund slightly outperformed its benchmark during the quarter, while outperforming at a greater scale YTD. This outperformance was heavily driven by the tactical duration positioning and yield curve positioning as rates moved lower and the yield curve began to flatten out during the quarter.

Market Overview:

– During 2019, long-duration bonds brought higher returns as international tariffs and uncertainty continued

– Regardless of the Fed and ECB easing, the Agg returned 2.3% for the quarter

§ 25bps reduction in July, 25bps reduction in September, 25bps reduction in October

– The S&P 500 total return was 1.7% during Q3 2019, yet large differences existed between sectors

§ YTD, the S&P 500 is up over 20%, gaining almost 3.5% in October

§ Utilities were up the most at 9.3% for the quarter, while Energy was down 6.2%

– U.S. equities and fixed income markets have outpaced the returns of both developed and emerging markets

§ Barclays Agg up 8.5% YTD

§ Investment grade corporates up 3.1% for quarter, 13.2% YTD

– The Fed is not planning on raising rates until inflation reaches a consistent level of 2%

– Labor market remained strong during the quarter with an unemployment rate that fell from 3.7% to 3.5%

Performance Review:

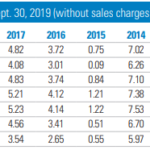

– In Q3 2019, WATFX outperformed the Barclays U.S. Agg Index by 3bps

§ WATFX returned 2.30%, while the Agg returned 2.27%

– YTD, WATFX outperformed the benchmark (Barclays Agg) by 122bps, mainly due to strong duration and yield positioning

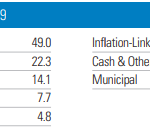

– Exposure to structured products (CMBS, ABS, & non-agency MBS) helped increase returns as their spreads continued to narrow

– Allocation to TIPS created headwind, though, as inflation rates fell

– Numerous changes were made the portfolio during the quarter

§ Adjusted duration

§ Lowered exposure to investment-grade corporates

§ Increased allocation to agency MBS

Market Outlook:

– Looking past the rise in downside risks, global growth looks to continue through the resilient strength of the consumer and monetary stimulus being supplied by both developed and emerging market central banks

– Estimating U.S. growth to finish at 2.0-2.25% for 2019, with no spikes in inflation in the near to mid-term

– International strengths and optimism

§ Eurozone growth is expected to reach 1% for 2019 and 2020

§ The Bank of Japan’s monetary policy is expected to stay as they continue to try to meet an inflation rate of 2%

§ Declining inflation in EM countries is allowing central banks to decrease rates which will ultimately support economic activity

– Yield spreads between EM and developed markets have potential to compress

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109