Current Price: $1,434 Price Target: under review

Position Size: 4.9% TTM Performance: +25%

Alphabet missed estimates but improved disclosures. The stock is down today, but about even with where it opened yesterday. For the first time they broke out YouTube revenue separate from search revenue and also disclosed Cloud revenue. Despite the miss, 2019 revenue grew +20% (that’s $25B in incremental revenue for the year). Weaker hardware sales contributed to the 4Q miss, but they saw ongoing strength in YouTube and Google Cloud.

Key takeaways:

· Top growth drivers were mobile search, YouTube and cloud.

· Ad Revenue:

o Google properties (includes search and YouTube) grew ~17% in FY19, which continues to grow faster than Network member sites at +7% – these are ads placed on sites that Google does not own.

o Search revenue was +15% (a deceleration from +22% in 2018) and YouTube was +36%.

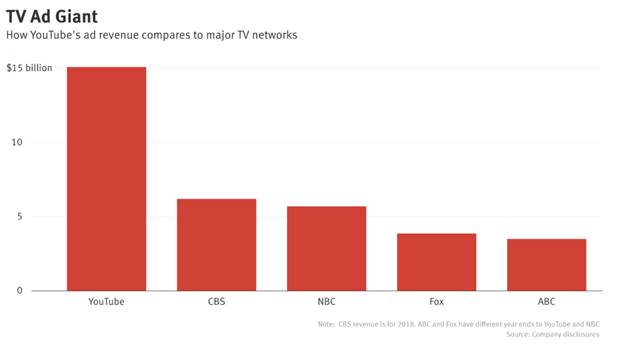

o YouTube ad revenue was revealed to be a $15B business – there seemed to be a wide range of estimates on how big this was, but this is in the range. Interestingly, their YouTube ad revenue is bigger than CBS, NBC, Fox and ABC ad revenue combined. See chart below.

o They do not report YouTube’s profitability.

· Google Cloud was +53% and is at a $10B run rate. GCP’s growth rate accelerated from 2018 to 2019. Commentary around this business, including backlog, was very strong. They are investing heavily behind this.

· Google Other Revenues (includes Google Play, Hardware and YouTube’s non-advertising revenue)

o In Q4, other revenues were up 10% YoY, primarily driven by growth in YouTube and Play, offset by declines in hardware. Lapping product launched contributed to lower growth.

o YouTube now has over 20 million music and premium paid subscribers and over 2 million YouTube TV paid subscribers, ending 2019 at a $3 billion annual run rate in YouTube subscriptions and other non-advertising revenues. They also have a YouTube shopping initiative where people can now buy products in YouTube’s home feed and search results.

· Other Bets: Losses grew. Management brought up the intention to get outside investors in these businesses. Verily is an example of a company in the portfolio that has outside investors like Silver Lake. They said they would consider opportunities for some of their Other Bets to take similar steps over time.

· Key expense lines:

o Higher cost of revenues driven by costs associated with data centers and servers, and content acquisition costs, primarily for YouTube.

o Headcount was key driver in opex increases. They added 20k employees in 2019, an increase of over 20%! Majority of new hires were engineers and product managers. The most sizable headcount increases were again in Google Cloud for both technical and sales roles.

· Share buybacks increased 59% QoQ.

Valuation:

· Reasonably valued, trading at ~3.5-4% FCF yield on 2020.

· $105B in net cash, ~11% of their market cap.

$G OOGL.US

[category earnings]

[tag GOOGL]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109