Amazon reported Q4 revenue above consensus forecasts, with the company exceeding the high-end of its revenue guidance for the first time since 1Q18. AWS revenue grew +34%. The big positive surprises in the quarter were an acceleration in N. American revenues (chart below) and better than feared AWS sales (estimates had been coming down). The AWS result (+34%), while a deceleration, was a relief given concerns of an even bigger deceleration from share losses to Azure. Operating income came in above consensus though margins contracted ~80bps YoY.

Guidance: Management guided to Q1 revenue of $69B – $73B vs. consensus of $71.6B. Guidance implies growth of +16% to +22% YoY. They guided Q1 operating income of $3B – $4.2B vs. consensus of $4.1B, but this guidance includes an ~$800m lower depreciation expense due to an increase in the estimated useful life of servers.

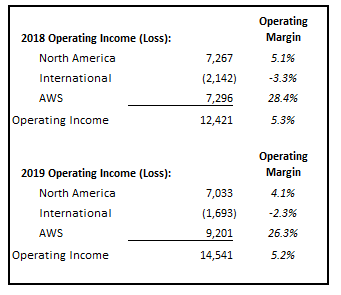

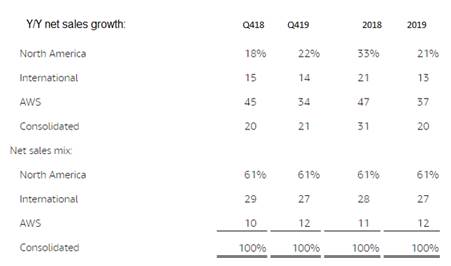

N. A. Retail sales up, but profitability down: Online (+15% in Q4) and 3rd party seller services (+31% in Q4) both accelerated from Q418. Since third party fees grew faster than online sales, either their share of gross merchandise volume (GMV) grew or their take rate did. The sustainability of their nearly 27% take rate, which is a key retail profit driver for them, continues to be a risk. This accelerated growth was driven by expensive one-day delivery (which was expanded to lower priced items) that pushed e-commerce sales up, but also drove shipping costs up (to $12.9B) +43% and, as a result, operating margins lower in North America. This is reflected in N. American segment revenues accelerating to 22% from 18% and operating margins that deteriorated 150bps in Q4 and ~100bps for the full year. So, despite the robust top line growth, N. American profit dollars were down YoY – in Q4 from $2.3B to $1.9B and for the year from $7.3B in 2018 to $7B in 2019. Given that advertising and Prime fees are included in their N. American operating profit, these high margin businesses are clearly driving all of that 4.1% margin and making up for higher losses in retail. This suggests that the unit economics in North American retail continue to be challenged as one day shipping just increased their variable costs. International is still not profitable and operating income for Q4 was essentially flat (~$600m loss) on sales up 14%.

AWS not as bad as feared, but losing share to Azure and margins down: AWS is their primary source of profitability but decelerating and losing share to Azure which grew 64% this quarter, well ahead of AWS’s 34%. AWS margins declined >300bps YoY in Q4 and ~200bps YoY for FY19. By contrast, MSFT just reported Azure margins up 500bps. Alphabet’s cloud investments also pose a growing competitive threat to AWS. Mounting pressure on the AWS business seems to be one of the biggest fears of investors.

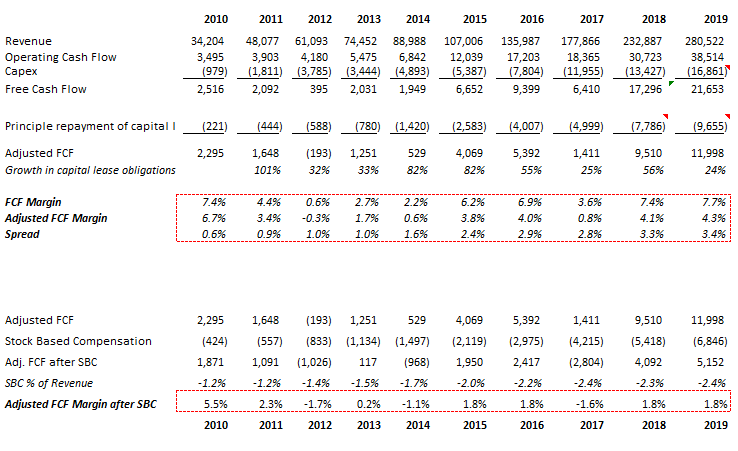

Trends with their FCF margins continue – valuation is still very expensive: Adj. FCF margins were 4.3% (similar to 2018) resulting in ~$12B in FCF after capital leases. This is ~1.2% TTM FCF yield. The stock continues to be very expensive. Importantly, this $12B in FCF benefits from the $6.8B they pay in non-cash compensation through SBC and the $1.4B in excess tax benefits they get from SBC on top of that. Many analysts seem to use a sum of the parts valuation that places a multiple on GMV to value their online business. The problem with this is that it may be overstating the value of a retail business that continues to be subscale (i.e. losing money) w/ now likely over $340B in gross sales (GMV) and whose unit economics appear to be going in the wrong direction.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$AMZN.US

[category earnings]

[tag AMZN]