Key takeaways:

1. Current RevPAR trends are slowing, but still expected to be slightly positive in 2020.

2. Their asset light model and solid net unit growth means they are less sensitive to macro driven RevPAR trends. Despite weakening RevPAR, Hilton continues to grow EBITDA and FCF/share aided by 6-7% unit growth, and a robust pipeline that represents 40% future room growth.

3. Coronavirus is not in guidance, but likely not more than -1% impact to overall FY RevPAR and 50bps impact to unit growth. This could be ~-1% to -2% impact to FY20 EBITDA (China is only 2.7% of their EBITDA). They have shut down 150 hotels (33k rooms) in China which they are estimating could be closed for 3-6 months and an additional 3-6 months of recovery period.

Share Price: $114 Target Price: Raising to $137 from $105

Position Size: 3% 1 Yr. Return: 55%

Hilton beat on revenue and EPS – Q4 RevPAR was slightly below expectations, offset by higher licensing fees. On ~1% FY19 RevPAR growth, they grew EBITDA 10% and EPS 14%, demonstrating the strength of their asset light business model and strong unit growth. While RevPAR is weakening, Hilton’s robust development story means they are a lot less dependent on macro driven RevPAR. Their business model is structurally different than it was last cycle because they own fewer of their hotels and instead receive high margin management and franchise fees. About 7% of their EBITDA is generated from owned hotels vs over 40% in the last recession – this asset light model means less operating leverage and a less volatile earnings stream if RevPAR continues to weaken. Moreover, unit growth will aid EBITDA growth regardless of RevPAR trends. (RevPAR = revenue per available room. It’s their total room revenue divided by their total number of rooms). Their development pipeline is delivering 6-7% unit growth and has some countercyclical aspects. In 2019 they returned more than 8% of their market cap to shareholders in the form of buybacks and dividends. The stock is undervalued, trading at ~4.5% FCF yield on 2020.

Highlights:

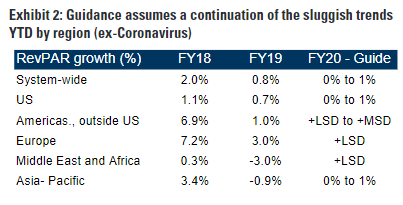

· Currency neutral system-wide RevPAR was -1% for Q4 and +0.8% for the full year. They maintained 2020 RevPAR guidance of 0% to +1% and expect 2020 net unit growth of 6-7%.

· Q4 by geography – Q4 US RevPAR fell 80 bps, on softer business travel. Europe was +1.4%, Overall AsiaPac was -3.8% and w/in that China was -7.8% (includes impact from Hong Kong), Middle East & Africa was -4.3% (political tensions in Lebanon and supply growth in the UAE continued to pressure rate). Full year stats in chart below.

· Softer business travel negatively impacted results in the US. Corporate demand (transient and group) drives 70%+ of HLT’s business system-wide.

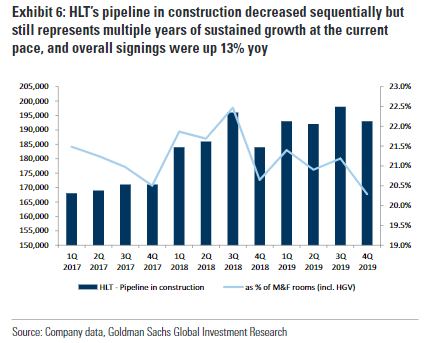

· Solid pipeline continues to drive capital efficient growth – Current pipeline represents close to 40% unit growth or 387k rooms. That is several years’ worth of growth w/ over 50% of that pipeline under construction, the majority of which are outside the US. More than 90% of their deals do not require any capital from them.

· In a sensitivity analysis to a market downturn, mgmt. said they would expect flat to slightly positive growth in adjusted EBITDA and positive growth in free cash flow in an environment where RevPAR were to decline 5% to 6%. This is b/c unit growth will aid EBITDA growth regardless of RevPAR trends.

· Continued strength in their market leading RevPAR index = counter-cyclicality – RevPAR index is their RevPAR premium/discount relative to peers adjusted for chain scale. They are the market leaders – this is helpful because it’s what leads to pipeline growth (hotel operators want to associate w/ the brand that yields the best rates and occupancy) and is helpful in a macro downturn because it’s even more crucial for a developer to be associated with a market leading brand to get financing. i.e. they would likely take more pipeline share if lending standards tighten. The other countercyclical aspect of their pipeline growth is conversions (an existing hotel changes their banner to Hilton). I.e. Hampton Inn (35 year old brand) has a RevPAR index of 120.

· Loyalty members hit 104m and account for >64% of system-wide occupancy. Loyalty members continues to grow and % penetration continues to improve – both of which bode well for LT RevPAR trends as they typically see a doubling of wallet share once a customer signs up for the loyalty, and share improves w/ status level. They get 75-80% share of hotel wallet from Diamond Honors customers.

· In 2019 they returned more than 8% of their market cap to shareholders in the form of buybacks and dividends.

· The stock is undervalued, trading at ~4.5% FCF yield on 2020.

Investment Thesis:

∙ Hotel operator and franchiser with geographic and chain scale diversity of 17 brands, 6,100 hotels and 970k rooms across 119 countries (Hilton, DoubleTree, Hampton Inn & Hilton Garden Inn ≈ 80% of portfolio).

∙ Network effect moat of leading hotel brand and global scale lead to room revenue premiums and lower distribution costs.

∙ Shift from hotel ownership to franchising results in resilient, asset-light, fee-based model.

∙ Record pipeline generating substantial returns on minimal capital will lead to increasing ROIC and a higher multiple.

∙ Unit growth and fee based model reduce cyclicality – Lower operating leverage vs ownership reduces earnings volatility and unit growth offsets potential room rate weakness.

∙ Generating significant cash which is returned to shareholders through dividends and buybacks.

$HLT.US

[category earnings]

[tag HLT]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109