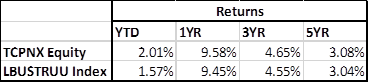

TCPNX Commentary – Q4 2019

Thesis

TCPNX is a smaller fund that does not have as many assets under management compared to our other core mangers, enabling them to make more nimble and tactical decisions. By making small allocations to undervalued “riskier” asset classes (high-yield and non-dollar denominated debt), TCPNX diversifies our fixed income portfolio and generates superior returns to the benchmark (Barclays U.S. AGG). We like that the fund utilizes a bottom-up investment process through proprietary framework analysis, fundamental security review, and portfolio risk management.

Overview

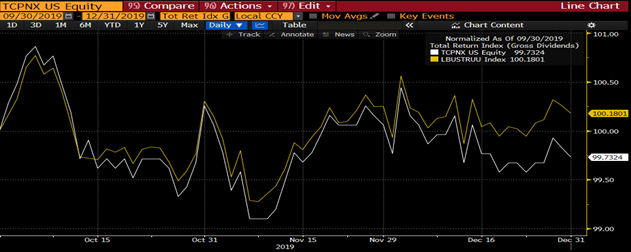

In the last quarter of 2019, TCPNX underperformed the benchmark (Barclays U.S. AGG) by 45bps. Security selection contribution was mainly focused on long duration corporate bonds which underperformed as U.S. Treasury yields moved up, municipal housing which had mixed performance due to a mix in payment speed and ability, and lower quality corporates which outperformed as the demand for yield and risk increased. TCPNX also added three new funds which are based around supporting housing for lower income families, improving energy and water efficiency, and providing housing for the homeless and mentally impaired, while selling out of Chesapeake Energy due to its drift from natural gas to crude oil exposure.

Q4 2019 Summary

– TCPNX returned (0.27)%, while the U.S. AGG returned 0.18%

– Year-end effective duration for TCPNX was 5.7 and 5.9 for the U.S. AGG

– Long corporate exposure was underweight

o Largest gains in Fixed Income space for 2019

– Overweight Agency Multi-Family MBS and U.S. Agencies which detracted from returns

– Underweight long corporates and BBB-rated longer duration credits, both classes outperformed

Optimistic Outlook

– We continue to hold this fund and believe in our thesis due to the fund’s consistent and defensive approach that we expect to generate alpha through times of low volatility

– To keep liquidity high, TCPNX has positioned themselves with more cash and U.S. Treasuries than usual

– TCPNX’s overweighting spread products, U.S. Agencies, and less volatile corporate securities prepares them for a strong 2020

o Fund managers are expecting lower risk which will create tailwinds for the fund compared to 2019

– TCPNX’s positioning created an expected headwind during 2019’s high level of risk and volatility, but will look for outperformance in 2020 as volatility and yield movements drop

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109