AFVZX Commentary – Q4 2019

Thesis

AFVZX is our only active manager in the large cap U.S. equity markets and applies a quality and value tilt to their investment strategy, holding roughly 50 companies. By utilizing DCF models, bottom-up fundamentals, and holding sector weights that are equivalent to their benchmark (S&P 500 Index), the fund generates alpha over time purely through stock selection. We continue to hold AFVZX because of the team’s ability to compare stocks across all sectors which enables them to generate strong returns over the long run.

Overview

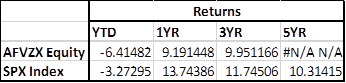

In the last quarter of 2019, AFVZX underperformed the benchmark (S&P 500 Index) by 54bps yet outperformed over the year by 67bps. Underperformance was mainly due to Consumer Staples, Financials, Healthcare, Materials, and Utilities, while strong outperformance was led by Consumer Discretionary, Energy, Industrials, and Real Estate (REITs). No changes were made during the quarter, yet the fund managers are ready to replace AGN in the near future.

Q4 2019 Summary

– AFVZX returned 8.53%, while the S&P 500 Index returned 9.07%

– Underperformance in Healthcare was mostly driven by a lack of exposure to managed care

– Underperformance in Information Technology stemmed from weak earnings/guidance reported

– Top contributors included holdings within Consumer Discretionary, Energy, and REITs

o Consumer Discretionary: outperformance led by TGT and LKQ

o Energy: steady rise in oil prices during the quarter helped lift performance for NOV and COP

o REITs: improved sentiment towards global and U.S. economic outlook helped HST outperform REIT peers

Optimistic Outlook

– We continue to hold this fund and believe in our thesis due to the fund’s ability to outperform the index over the long run through strong stock selection and maintaining a quality and value investment tilt

– The fund mangers are expecting at least 3 tailwinds for the economy in 2020

o Reduced uncertainty on U.S.-China trade war

o Implementation of USMCA

o Fading uncertainty with Brexit

– The U.S. election will set the tone for the next decade, yet the fund expects that the U.S. economy and market will continue to be strong and act as the safe haven for investors

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109