Just sharing some thoughts on Hilton and exposure to Coronavirus impact and, in general, the impact of a weakening environment…

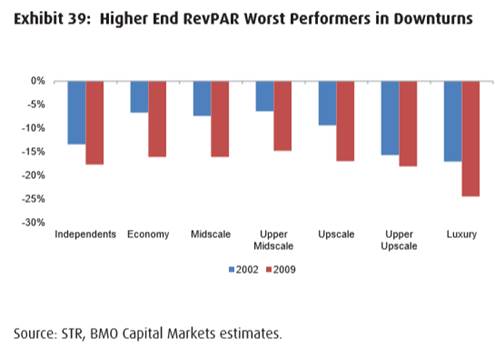

· RevPAR in previous downturns:

o The last two major downturns in RevPar we have seen were with the Financial Crisis and after 9/11. In 2001, US RevPAR was down 7%, then down 2.7% in 2002. In 2009, US RevPar was down 16.5% then was up 5% in 2010.

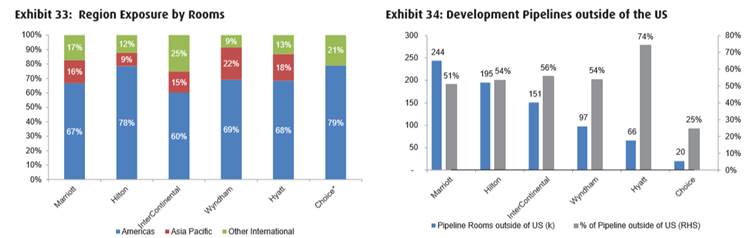

o Not a perfect comparison to now b/c of the severity of the recession w/ the Financial Crisis. And 9/11 may have had a longer term impact given general fears around traveling that persisted. Geographically, they are most exposed to the Americas (78% of rooms).

o Absent a recession, one would expect a quick-ish recovery after fears of the virus have abated.

· Pipeline Growth protects in a downturn:

o In a sensitivity analysis to a market downturn, mgmt. said they would expect flat to slightly positive growth in EBITDA and positive growth in FCF in an environment where RevPAR were to decline 5% to 6%.

o The reason they could still grow in a downturn is their massive pipeline of new rooms which equate to 40% of their existing room base and more than 50% of that pipeline is already under construction.

o They project room growth of ~6% per year, so several years of room growth is already under construction. Lower rates means financing for developers just got cheaper. If things get worse, independents are more likely to run for cover with a brand which makes conversions a bit countercyclical. This could aid room growth.

· Asset Light w/ high mix of Franchise fees is a buffer…

o In the event of a more severe and prolonged downturn, profits should fall more in line with top line given the asset light model. This is different than previous downturns, where they owned more of their hotels. That means higher fixed costs and higher operating leverage, in which case profits would fall much faster than sales.

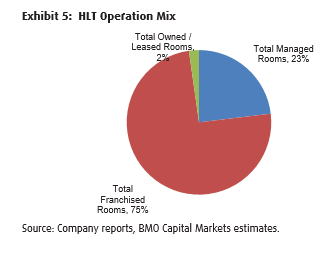

o 75% of HLT’s rooms are under franchise agreements, 23% under management agreements versus 2% still owned by the company.

o This higher mix of franchise rooms than Managed rooms is helpful in a downturn because the fee stream in franchising is not tied to profitability. So it is the less volatile of the two and a differentiator between them and Marriott. Franchise rooms are straight royalty, while hotels w/ Management agreements have Incentive Fees built in that are tied to profits, and, as a result, disproportionately impacted due to the high fixed cost structure of the business.

· Low mix of Luxury: Luxury tends to be the worst performing segment in a downturn and HLT has very low luxury exposure at 3% of rooms vs 19% for Hyatt and 9% for Marriott. See chart below.

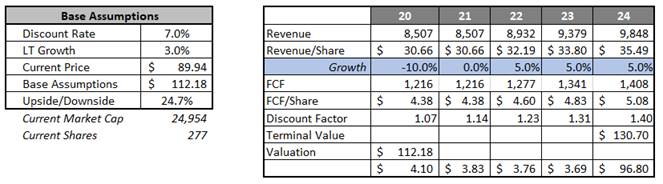

· Valuation: This is not a projection, just a sensitivity analysis. But this assumes -10% top line and flat in 2021. Given pipeline growth, RevPAR would have to be way worse than 10% for this to happen. Given the upside in such a scenario, you could argue the valuation is pricing in something worse than this.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$HLT.US

[category equity research]

[tag HLT]