It seems economists are waiting for the data to confirm a slowdown and reluctant to state what seems inevitable given the growing response to the continued spread of the coronavirus.

Prior to the onset of the coronavirus, 2020 GDP growth expectation were in the range of 1.5%-2.5% based on long term demographic drivers and growth in US productivity. From quarter to quarter this target varies based on trade policies, Federal Reserve actions, government stimuli and extraneous items like the Boeing’s production issues with the Max 737. Our concern for the economy is the lower the trend line growth, the more easily it can get tipped into a recession. The expected coronavirus related shutdowns in the US have significantly increased the probability of a recession. Safe to say we are on recession watch.

Economically, the closures of schools, businesses, restrictions to travel and perhaps regional shutdowns will hamper GDP growth. Currently consumers are assessing daily plans to visit public spaces, travel and spend money. Consumption is 70% of GDP, so any restraint on consumer spending will have an impact on GDP growth. Businesses will feel a slowdown as supply chains continue to be disrupted, consumption falls and international sales delays worsen.

Signals pointing to a recession:

1. Slowdown in global growth especially in areas already impacted by this virus – China/Korea/Italy – will drag down US exports

2. Stock market correction – Since 1926, 14 of the 19 corrections of 15% or more have predicted recessions

3. Bond markets – Yield curve inversion and collapse of US Treasury yields implies growth slowdown

Assumptions (Not trivial):

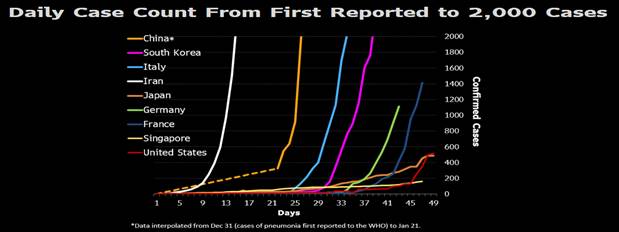

1. That the spread of the coronavirus in the US causes widespread closures of schools and businesses. Given the below chart, I would expect cases in the US to shoot up in a similar pattern. I don’t believe the US is any different than other countries. If we do show a different uptake on reported cases, it is due to the current lack of available coronavirus testing in the US.

2. That the shutdowns will slow GDP by 3.0% or more for two consecutive quarters. The travel and tourism industry generated 10.4% of the world’s total economic activity. I think it would be safe to say that this industry contracted by one third during this global slowdown. So, it is possible that a slowdown in the global tourism industry alone, could swing the US and other countries into a recession. Of course, other industries have been hit as well.

Importantly we expect a shallow recession:

1. Federal Reserve has cut rates and will, most likely, do so again. Lower rates will spur refinancing and help indebted consumers and businesses. However, interest rate cuts take several months to affect GDP growth.

2. The US government is planning a payroll tax cut or some stimulus. The size and scope are currently unknown, but this could have an immediate impact on US GDP growth.

3. Jobs and housing remain healthy, but these are lagging indicators.

4. Importantly, the banking sector is on solid footing. Unlike 2008/9, we would not expect to see an expensive recapitalization of the nation’s banking sector.

5. Lower oil prices will help consumers and energy intensive businesses.

Portfolio comments:

1. Equities

o Using market swings to find stocks that improve quality of portfolio selling at attractive valuations – adding ACN and reviewing other quality names and adjusting weights.

o Focus on strong free cash flow companies with strong balance sheets that will withstand demand disruption.

o Quality of management is important in times like these. Capital allocation, shareholder friendly and ESG quality show that the management team is focused on improving shareholder value.

2. Bonds

o Focus on quality – Lower quality bonds have fallen due to concerns that defaults may rise. High yield bonds are down -7% YTD, while US Bond market is up 5% YTD

o Considering US Treasury bond yields are at all-time lows, we will focus on providing diversification, current yield and reduced risk from bonds. We are reviewing changes to our duration (possibly shortening) and looking for safe ways to generate higher income. The 10-year UST yield has fallen to 0.57%, which is a very good indicator of the future 10-year return on that bond. For the next 10 years expect an annual return of .57% – ugh. This low return highlights the need to find alternative ways to increase returns.

Staying the course – passing on this excellent quote from Ben Carlson’s blog: “These are the days when you don’t need financial advice, you need a psychologist. This is why managing people is always more important than managing investments when you work in the financial services industry. Anyone can build a portfolio. Not everyone can stick to a plan.”

In conclusion, our portfolios are constructed accounting for periods of high volatility and downside protection. We focus on a concentrated portfolio of high quality companies held through a market cycle. We expect our bonds to reduce portfolio volatility and provide some upside when stocks are falling. Our alternatives are intended to add diversification and improve portfolio risk/return characteristics. Our portfolios are not immune to market actions, but they have smoothed the ride for clients as we hoped when we built them.

It would be great to hold cash through periods like the past two weeks, but the large daily ups and downs show the importance of staying invested. Clearly, it is difficult to get out of the market before stocks fall and to get back in before the market rebounds. Market timing is a two-part decision that neither the fearful nor the exuberant get correct.

Please let me know if you have any questions.

Thanks,

John

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109