Sensata has traded down ~33% YTD due to car manufacturing disruptions from the coronavirus (plant closures globally and supply chain disruptions). Sensata’s new CEO announced yesterday that their own plants were functioning close to normal levels. A reminder that 60% of ST’s business is related to the auto end market, and ~17% of their sales come from China (~30% in Asia, 28% Europe, 42% Americas).

The bear thesis on ST has been around product mix evolution being unfavorable to ST (growth of EV vehicles vs. combustion engine – where ST had historically less content) and the decline of car sales globally. The coronavirus disruption has certainly accelerated this negative sentiment. Here’s where we disagree with the bears, and think ST valuation is attractive:

· ST has been transforming its portfolio through recent acquisitions. The Gigavac acquisition gives them increased content into electric vehicles:

ü Sensata’s average content on a pure electric vehicle is now at par with content on both diesel and gasoline vehicles (~$40), with a total opportunity on EVs much higher than the average content

ü The high voltage contactor technology (seen in electric vehicles) can range to $60-$100 of content per vehicle on average – much higher than in combustion engines

· Content growth has grown in the last couple of years, leading to sales growth above market growth

Here’s some background information on the car industry, as we try to frame the coronavirus impact on Sensata’s business in 2020:

· Wuhan is a major auto/auto parts production hub: ~10% of vehicles made in the country and home to hundreds of parts suppliers

· The car maker most exposed to Wuhan is Honda: it produces 1.2M vehicles/yr in Wuhan (~20% of its total global production)

· According to the China Association of Automobile Manufacturers, 90% of the 300+ auto parts suppliers outside the Hubei province have resumed production, although at a lower rate (not all employees are back to work)

· Vehicle penetration in China still stands at only about 150 vehicles per 1,000 people, compared with approximately 700 vehicles per 1,000 people in the mature markets of the G7 – will the Chinese market might suffer near term, there are secular growth drivers for car sales growth in China

· More than 60% of the cars globally are produced in Asia and Oceania (~34% in China in 2016); Europe produces about 26%

Car sales decline per region due to the virus (as of this week):

· China: sales were down 19% in January and 92% in the first two weeks of February. Auto manufacturing plants were most likely closed for 6 weeks.

· South Korea—the country worst affected by the crisis outside China—car sales dropped by roughly -20% in February

· Japan: -10.7% in February

· Italy: -8.8% in February. This will most likely be worse in March

· Germany: -10.8% in February

· US: +8.5%, thanks at least in part to the leap-year effects

Car sales forecasts:

· Goldman Sachs downgraded its forecast for 2020 global auto sales to a decline of -3.5%, from -0.3%. That would be similar to the financial crisis of 2008/2009

· Moody’s: global auto sales could drop by 2.5% this year. Prior forecast was for a -0.9% decline.

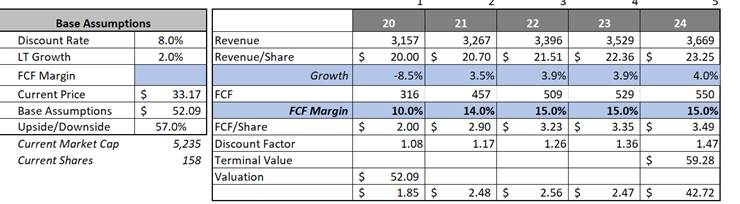

We looked at some worst case scenario for ST, and still see some margins for error in the stock price at today’s valuation. We believe the long-term thesis is not broken, even if 2020 will most likely see a hit to top line growth.

Our model for a “worsening” case scenario: top line decline of 8.5% and FCF impact pushing it to a 10% margin (lower than what it was in 2009 – although the company has evolved since then through acquisitions).

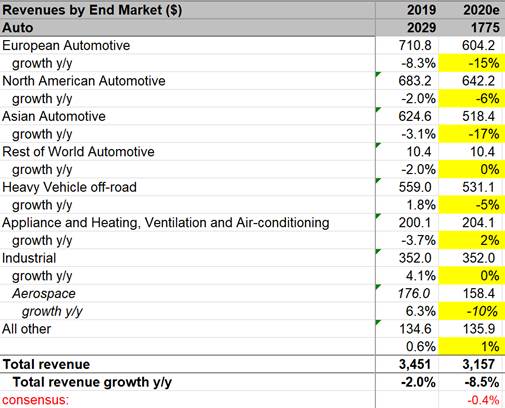

My thinking behind those numbers are shown below in the end-market sales. It reflects a crisis not as bad as 2008-2009 and car sales recovering in 2H 2020 –although for the entire year it will remain negative. My numbers for China and Europe are actually much worse than what Moody’s and GS are publishing in terms of global car sales (which means ST is both impacted by lower volume of car produced AND loosing content growth). See scenario below:

If 2020 ends up like 2008/2009, here’s what valuation looks like (same level of sales drop and even worse FCF in $ and margin):

Valuation is attractive:

<img width="730" height="565" id="Picture_x0020_1" src="http://investdigest.net/wp-content/uploads/2020/03/image004-1.png" alt="cid:image001.png@01D5F604.FB87A2D0“>

The Thesis on Sensata

- Sensata has a clear revenue growth strategy (content growth + bolt-on M&A)

- ST is diversifying its end markets exposure away from the cyclical auto sector over time through acquisitions, also expanding its addressable market size

- ST is a consolidator in a fragmented industry and still has room to acquire businesses

- Margins should expand as the integration of the prior two deals is under way, regardless of top line growth, and efficiencies in manufacturing are continuously pursued as they are gaining scale

- ST is deleveraging its balance sheet post acquisitions, leaving room for future M&A or a return to share buybacks, and improving EPS growth

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109