· Yesterday Booking announced that it is withdrawing its previously announced 1Q 2020 financial guidance as a result of the worsening impact of the COVID-19 outbreak on travel demand. This is not a surprise given that their primary market is Europe and Italy has gone into lockdown since Booking gave guidance (of Q1 revenue down -9% to -5%).

· From their press release: “the situation has worsened and the negative impact on travel demand has increased since we provided guidance, in particular more broadly across Europe and in North America”…”while the full impact and duration of the COVID-19 outbreak is unknown at this time, we have been through travel disruptions in the past and expect that this disruption will ultimately be temporary.”

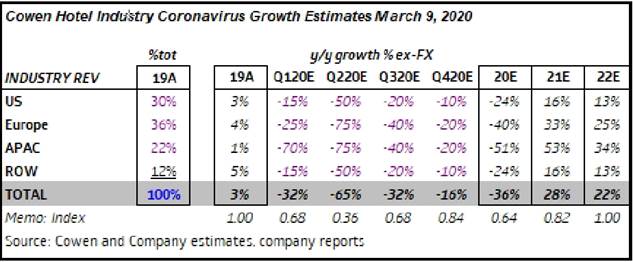

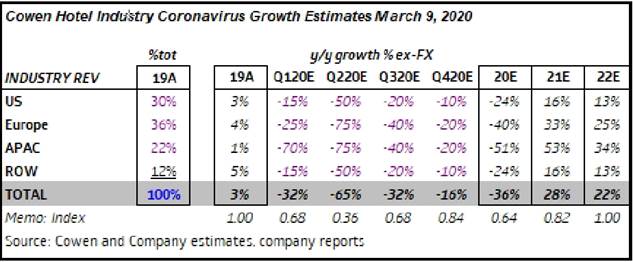

· The sell-side has started lowering numbers. The most aggressive I have seen is from Cowen…

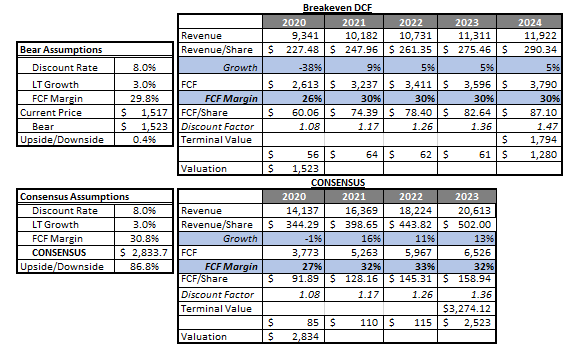

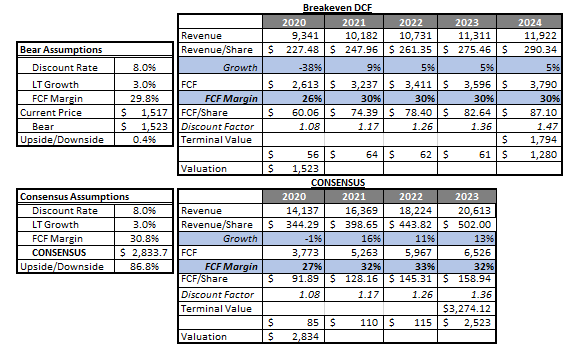

· Scenario analysis: The current valuation I believe is discounting a very severe impact from the coronavirus. In the first box I put together a breakeven DCF to try to contextualize this. The point of the breakeven DCF is to try to figure out what numbers imply the stock is fairly valued. Below that is consensus…some sell-side analysts have updated numbers, others have not. But it gives a sense of what investors had been expecting in the out years. Assuming consumer behavior is not permanently changed and/or a prolonged recession, the implied numbers are quite low (their 5 yr. avg. FCF margin is 33%). The 2020 number is a little below Cowen’s assumption, and my numbers don’t imply the recovery that Cowen does (or that management suggests). Cowen assumes the hotel market gets back to 2019 baseline by 2022. The breakeven analysis assumes they still aren’t there by 2024 (BKNG did $15B in rev last year and $4.5B in FCF). Additionally, they have a strong balance sheet, and not a lot of op leverage (their biggest cost is ad spend which they can toggle down) so margins should hold up.

· Given the bearishness of the breakeven DCF, from the perspective of upside/downside risk, the valuation is compelling. Booking is now at ~$62B market cap. If the environment returns to normal and they can do close to $6B in FCF in 2022 or 2023 and the stock returns to a 5-6% FCF yield, then it’s feasible to think the stock could be up 60-80% over that time period.

Here are some points that Cowen made about how their estimates could be better or worse than expected – I think these points are broadly applicable beyond BKNG…

Why things may be worse than projected:

· If containment/mitigation efforts are not successful, it is possible COVID-19 could create problematic outbreaks for multiple years.

· The outbreak and knock-on effects of social distancing, including the shock to travel, oil, and numerous other industries, could lead to significant layoffs and a potentially severe and prolonged global recession.

· It could take years to alleviate concerns over disease and the potential for extremely unpleasant and inconvenient travel-related quarantines.

Why things may be better than expected:

· COVID-19, at least as of now (this could easily change), appears to have been well contained in China and Korea. Outbreaks in Europe and the US may follow a similar pattern.

· Historically, travel has bounced back quickly from disasters and other disease scares.

· The number of people actually affected by COVID-19, at present, remains only a tiny fraction of other common viruses like seasonal influenza, in terms of both confirmed infections and deaths.

· The underlying economy, prior to the appearance of COVID-19, appeared to be very healthy.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

www.crestwoodadvisors.com

$BKNG.US

[category equity research]

[tag BKNG]