Key Takeaways:

· Revenue up 17%, operating profits up 31% from mix and manufacturing/procurement efficiencies

· Rapidly pivoted their business to produce more ventilators (life-support and non-invasive)

· SaaS growth of 12%

· Dividends maintained

Current price: $155 Price target: $168

Position size: 3.77% 1-year performance: +49%

Resmed reported sales and profit results above expectations, helped in part by the increased demand for ventilators. Results were good worldwide: the US/Canada/Latam saw a 12% growth, Europe/Asia/Row grew 27%, and SaaS +12%. Profits increased thanks to mix and operational efficiencies. The company highlighted in its presentation its efforts to help with the COVID-19 crisis, seeking a fair and ethical allocation of products globally, as well as transitioning its production lines to support the need for ventilators:

o ventilators production tripled to meet demand

o ventilation masks up 10x

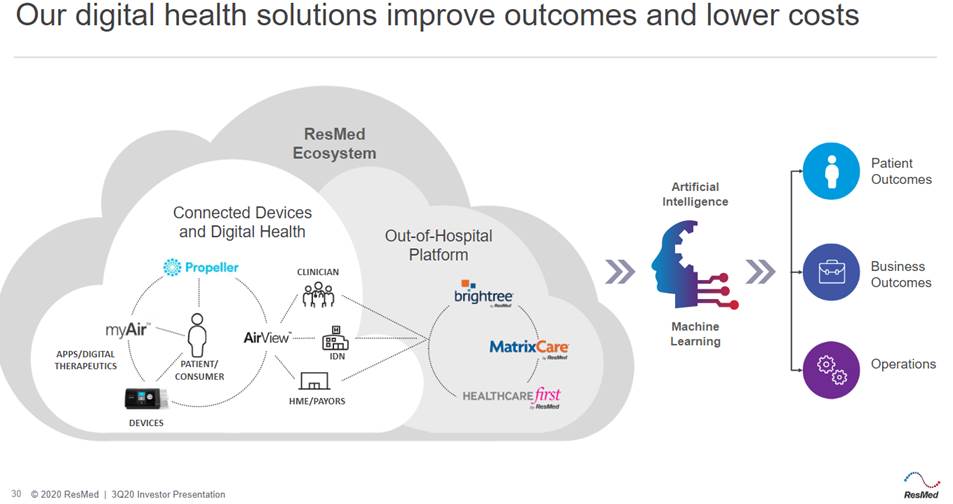

The management team believe this crisis will accelerate the need to monitor patients remotely (a big part of RMD’s growth strategy prior to the virus pandemic). See the chart below on how they are offering digital health solutions:

Thesis on RMD:

- Leading position in the underpenetrated sleep apnea space

- Duopoly market

- New product cycle

- Returns of capital to increase: ~1% share buyback/year (back in FY18), dividend yield of 2%

$RMD.US

[category earnings] [category equity research] [tag RMD]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109