Key Takeaways:

· Slow-down in all geographies due to COVID-19, but China recovering

· Margins held well due to restructuring actions (not likely to continue in Q2 with large drop in sales expected)

· Vontier IPO on hold until market conditions improve

· Guidance for the year removed

Current Price: $61 Price Target: $78 (NEW to reflect lower 2020)

Position Size: 2.08% 1-year performance: -25%

Fortive released its 1Q20 earnings last night, with core sales growth of -3.8% (+7.6% reported including recent acquisitions), but margins remained resilient this quarter with 150bps expansion led by restructuring actions taken in 2019.

The COVID-19 has impacted all geographies:

· China: activity picked back up in February/March, with plants operating at ~80% capacity

· EMEA was already challenging prior to COVID-19, activity worsen in March due to lockdowns, some countries starting to reopen (Germany) but too early to predict near future

· North America: deterioration in demand as quarter progressed with pressure pronounced in first half of April, lack of clarity on demand in Q2 as some states reopen

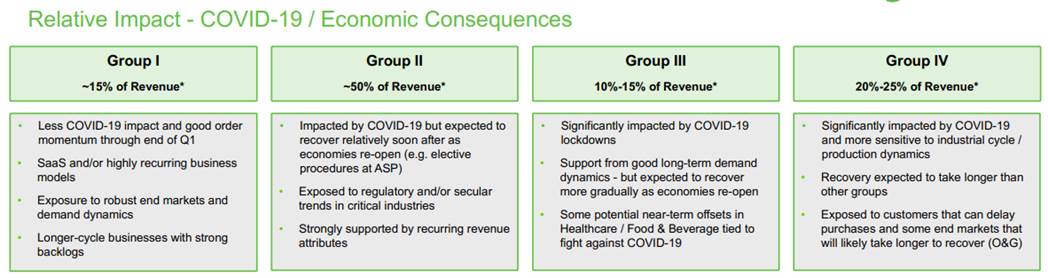

Fortive did a great job in categorizing its businesses and impact they have from COVID as a % of total revenue (see chart below). In summary 20-25% of the business will have a longer recovery from the crisis, 10-15% will see a gradual recovery, while the rest will return to normal pretty fast.

Due to current market conditions, the company is withdrawing the Vontier S-1 (separation of Fortive and Vontier was scheduled to happen by the end of the year). Just as a reminder, Fortive had planned to separate into 2 companies: Fortive (the industrial technology company) and Vontier (the retail and commercial fueling, fleet management, and automotive service and repair solutions). So far, FTV has accomplished the following steps towards the split: announced key members of the senior management team, launched the brand, and made progress against other significant milestones over the past few months.

Guidance for 2020 that was issued last quarter was also removed. They expect a 20-25% revenue decline in Q2 and a potential 35-40% decremental margin.

To manage their liquidity, FTV amended its net leverage covenant to 4.75x until Q1 2021 (from 3.5x), and push a term loan due in August to May 2021. The company is reducing discretionary expenses and managing working capital to maximize cash generation.

FTV Thesis:

– Market leader:

· Leadership position in most of the markets they serve

· Experienced leadership team

· Above industry margins with strong cash flows

– Quality:

· FCF yield ~5%

· Organic growth target of 3-3.5% (4-5% in last 2 quarters after being under the target in prior quarters)

· M&A strategy to enhance top line growth

· Margins expansion from new products introduction, continued application of the Fortive Business Systems and M&A integration

– Shareholder friendly:

· Management team focused on shareholder wealth creation through top line sustainability and margin expansion

$FTV.US

Category: earnings

Tag: FTV

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109