Key Takeaways:

· Organic sales boosted by pantry loading in the US

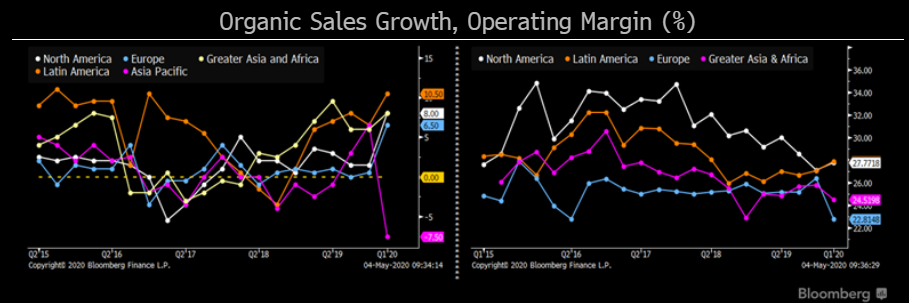

o EM sales +3%: negative impact from China and India lockdowns

o Developed markets: +11.5%

o Hill’s pet nutrition +21%

· 2020 guidance removed due to uncertainties on government measures to contain the pandemic

Current price: $70 Price target: $77

Position size: 1.82% 1 year performance: -1%

Colgate’s 1Q20 organic sales growth of 7.5% (highest since 2012) was boosted by pantry loading in Europe and even more so in the US. Colgate adapted its operations but still experienced out-of-stock in certain channels. While gross margins expanded 110 bps thanks to better pricing, efficiencies in production and easing commodity costs, the company spent more in advertising and logistics costs to meet demand, leaving operating margin unchanged from last year. The management team withdrew its 2020 guidance out of caution, although on the call they sounded pretty confident about the business (prior guidance was for a 3-% sales growth). April’s momentum seems positive as retail is rebuilding inventories.

The Thesis on Colgate

- High exposure to fast growing emerging markets (36% of Operating Profit from Latin America; 50%+ from EM)

- Defensive Product set (soap and toothpaste). Product line less vulnerable to trade downs due to low private label exposure in the categories

- Strong balance sheet (net debt/ebitda 1.4x) and highest ROIC in the sector

- 2.64% dividend yield

$CL.US [tag CL] [category earnings]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109