Key takeaways:

· Disney reported slightly better than expected revenue and missed on EPS. However, estimates have been wide ranging given the broad based nature of virus impact to their business.

· Parks hit the worst: Biggest hit from Covid-19 was to Parks business. Parks were tracking well ahead of expectations before virus hit. Shanghai Disney is opening on May 11 w/ requirements for masks and temperature checks. Date of domestic parks opening is still undetermined.

· Disney+ tracking ahead of expectations: 33.5m DTC subs at end of the quarter. As of May 4 they had 54.5m DTC subs. They’ve added ~26m subs in 3 months.

· Cut July dividend and reduced capex to preserve liquidity. They will re-visit potential reinstatement of dividend in 6 months (their dividend is semi-annual, not quarterly).

· No guidance.

· CEO Bob Chapek said… “We are seeing encouraging signs of a gradual return to some semblance of normalcy in China.”

Additional Highlights:

· EPS of $0.60 vs $0.86 consensus. Disney missed expectations for earnings as a result of severe impact to their Parks, Studio and Media businesses from COVID-19. The overall profit impact of COVID in the quarter was ~$1.4B, w/ Parks, Experiences & Products driving ~$1B of that.

· While much of their operations are shut down, they’ve been keeping their creative pipeline active including a number of writing and development projects and continuing post production work for their Media Networks, their studios and Disney+.

· Direct-to Consumer (DTC) & International:

o “…the response to Disney+ has exceeded even our highest expectations.”

o All DTC platforms are tracking ahead of expectations. Hulu will begin expanding internationally in 2021.

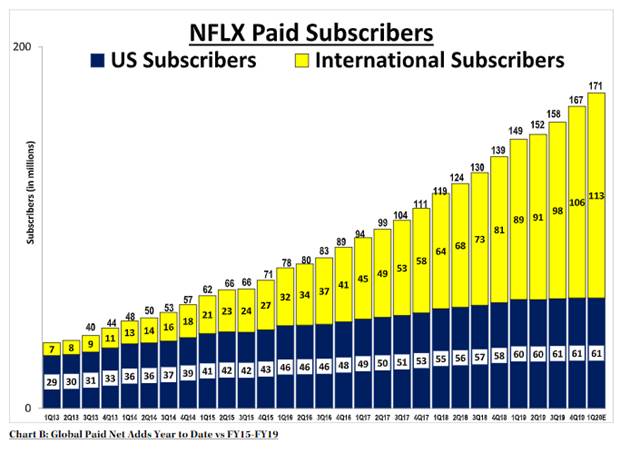

o For Disney+ they have already almost hit the 60m-90m global subs that mgmt. was targeting in year 5. They are ramping this business far faster than Netflix, which took several years to hit that mark. Disney went from 10m subs on day 1 (in November), to almost 55m now. NFLX reported 10m subs at the end of 2008. It took them until Q4 2014 to get >55m. For sure, not an entirely fair comparison as streaming was a newer concept then and broadband speeds were slower, but still a benchmark.

o Despite tracking ahead of expectations on subscribers, mgmt. said they are not going to update profitability guidance on DTC. The economics of this business are tracking better than expected – breakeven originally guided to 2024.

o Leveraging original content and ability to release directly to DTC to help offset studio impact. Frozen 2 and Pixar’s Onward which were released early as a special offering for families as a shelter at home. Artemis Fowl originally slated for a theatrical run will debut exclusively on Disney+ starting on June 12.

o DTC geographic expansion will continue to be a tailwind to sub growth: more geographies launching later this year. Will roll out in Japan in June, followed by the Nordics, Belgium, Luxembourg, and Portugal in September, and Latin America towards the end of 2020.

· Parks & Experiences:

o Solid trends ahead of virus: Attendance at domestic parks was down 11% in the second quarter – the 2wks of closure had a -18% impact, so YoY attendance was trending well. Per capita guest spending during the period the parks were open was up 13% on higher admissions, merchandise and food and beverage spending.

o Impact of parks closure: The parks are the hardest hit portion of their business. As a result, the cash burn rate of the parks is a focus right now. To put this in perspective, losses at the parks were estimated at $1B for the last two weeks of March with domestic half of that and Asia and cruise the other half. Fixed costs are depreciation, property taxes and insurance. So, a big chunk is non-cash. Variable is COGS which than can cut pretty quickly. Semi-fixed is labor (took them time to furlough and can’t furlough everyone) – this is >40% of costs. So, the $1B was before the company furloughed ~100k employees and Disney was able to take other variable costs out of the business, which offset roughly half of those losses, suggesting a current burn rate of $1B per month or $3B/quarter. Asia opening will decrease that number.

o Shanghai opening: The good news is, Disney has a lot of cash (and large undrawn revolver) and, if Shanghai is a template, that suggests US parks might open early-July given that Shanghai closed at the end of January, about 1.5 months before the domestic parks closed. Obviously it’s a fluid situation and assumes no major re-emergence of the virus.

o Shanghai Disney is opening w/ a phased approach w/ limits on attendance using advanced reservation, social distancing measures, masks, temperature screening and contact tracing.

o Cruises are part of this segment. They don’t break it out separately, but it is a small percentage of revenue & op income. Moreover, relative to other cruise lines, Disney tends to have a much younger passenger profile which may impact how quickly their consumer base is willing to return to cruising.

· Media:

o ESPN ad revenue declined 8% this quarter- lower viewership (cancellation of live sports) partially offset by higher pricing. So far this quarter, ESPN’s ad sales are pacing significantly below last year b/c of lack of live sports inventory coupled with limited advertiser demand. Ad revenue was ~15% of total revenue in 2019 with 2/3 of this from the Media segment (cable & broadcast) and the rest from DTC.

o ESPN ad revenue down 8%. Growth in affiliate revenue was more than offset by higher programming costs and lower advertising revenue. Couple of bright spots w/ their programming in the absence of live sports. Record viewership of “Last Dance” – the most viewed ESPN documentary ever and currently ranks as the #1 program in America amongst all key male demographics since sports halted. And most watched ever NFL draft – 55m viewers (+58% YoY) over the 3 day event. They didn’t mention HORSE….so maybe that was a bust.

o Mentioned that return of live sports may be a gradual process, where initial return is w/out spectators in the stands.

· Studio:

o Had to reschedule a number of release dates for “tentpole” movies including Mulan for July 24, Marvel’s Black Widow for November 6, and Pixar’s Soul on November 20. Artemis Fowl originally slated for a theatrical run will debut exclusively on Disney+ starting on June 12.

o Re-opening of theaters in China would be helpful, but domestic market is bigger. Impact varies by movie and the number of movies they can show is limited b/c China’s regulators limit the number of foreign films that can be shown in theaters each year. Attaining a slot can significantly boost a movie’s global box office. China made up ~22% of Avenger Endgame’s total box office – which is larger than what’s typical and was the biggest Hollywood film ever in China. In general, super hero movies tend to do well in the Chinese market, more so than animated movies. Most recently, about 8.5% of Frozen 2’s box office was from China.

· Liquidity measures: they have been focused on strengthening their liquidity position to ensure they have adequate resources during this crisis. To that end, they cut the July dividend and are reducing capex plans to preserve liquidity. They will re-visit potential reinstatement of dividend in 6 months (their dividend is semi-annual, not quarterly). They have >$15B in cash and total credit facility capacity of >$17B. $12B of that credit facility serves to backstop their commercial paper program.

Investment Thesis:

- Disney is a global media and entertainment company that owns a massive library of intellectual property.

- Their competitive advantage is their evergreen brands and synergistic business model. Disney can create content that builds off existing franchises and can be monetized across all their business, giving them the ability to create higher budget, quality content and an ever growing library of IP.

- New direct-to-consumer (DTC) initiative will strengthen synergies between businesses and lead to structurally higher margins and higher multiple on recurring revenue business.

- Recent Fox acquisition improves their content positioning and global growth opportunities.

- High quality company with solid balance sheet, strong FCF generation and ROIC.

$DIS.US

[category earnings]

[tag DIS]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109