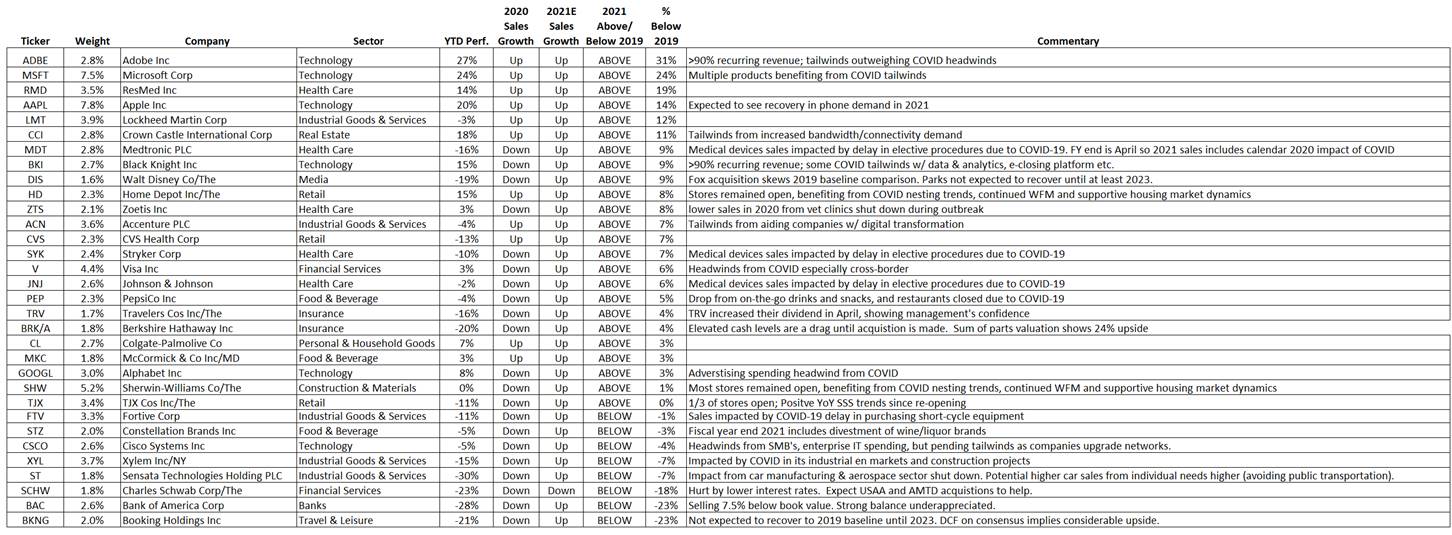

Sharing some interesting stats and charts on how the U.S. economy is recovering from coronavirus… for restaurants, hotels and airlines overall negative but improving. For housing, stats point to a supply/demand picture that should support pricing (good news for our housing related names SHW, HD, BKI).

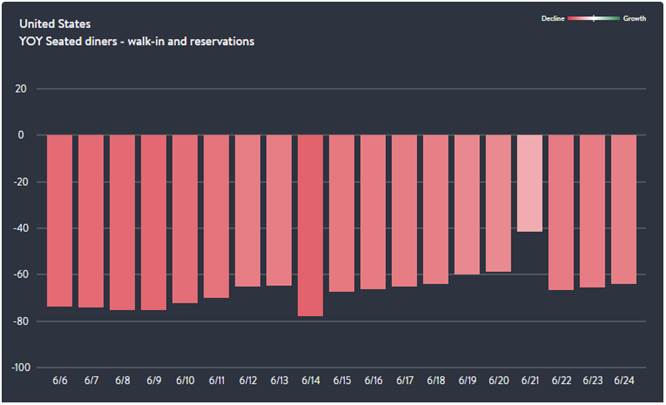

· Restaurants: Opentable restaurant bookings are down 60% YoY. Opentable is also saying 25% of restaurants will close in the US.

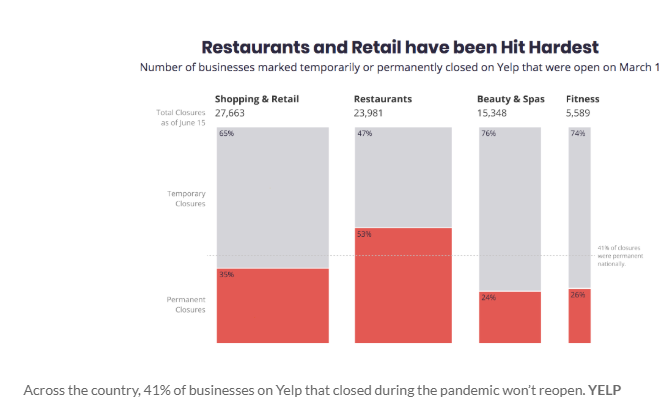

· Yelp says 41% of businesses listed on their site that have closed due to Covid will not re-open. Retail and restaurants are hardest hit.

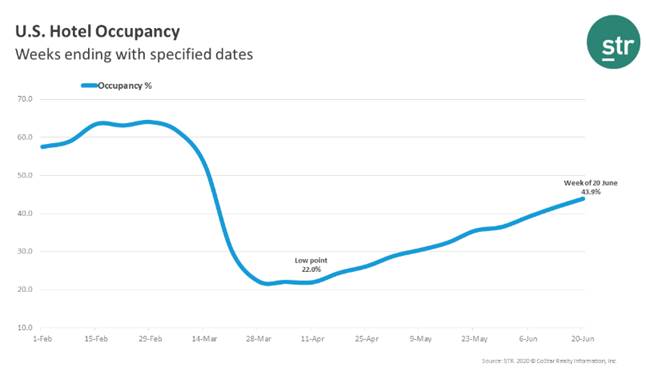

· Hotels:

o US Occupancy: 43.9% (-41.8% YoY).

o US Average daily rate (ADR): US$92.20 (-31.7% YoY)

o US Revenue per available room (RevPAR): US$40.48 (-60.3% YoY)

o The Top 25 Markets showed lower occupancy (38.4%) than the national average. Highest are Virginia Beach (54%), Tampa/St. Petersburg, Florida (49.4%); Phoenix, Arizona (48.3%); and Detroit, Michigan (46.2%). Boston was among the lowest at 26%.

o STR’s senior VP of lodging insights: “Demand continues to be pushed upward by drive-to spots and the destinations with outdoor offerings such as beaches.”

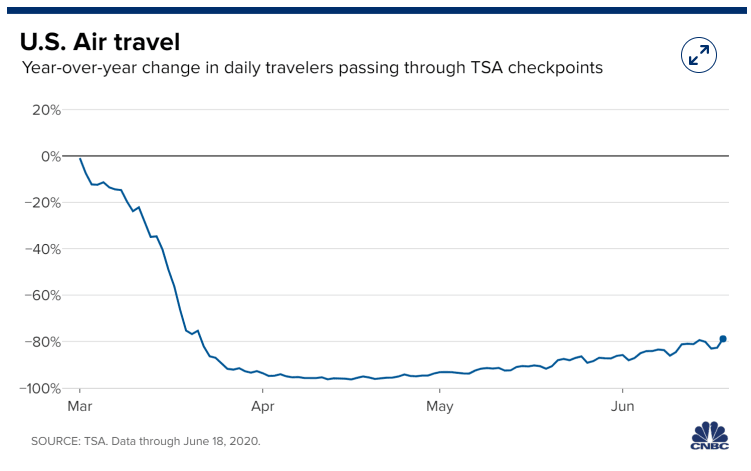

· Airlines: As of 6/24, TSA reported 494,826 daily travelers going through airport security checkpoints which is down ~80% compared to 2,594,661 last year (TSA). This is up ~450% from the worst week reported since the crisis (4/12) of 90k daily passengers which was down 96% YoY.

· Housing: Positive housing stats point to a supply/demand picture that should support pricing…

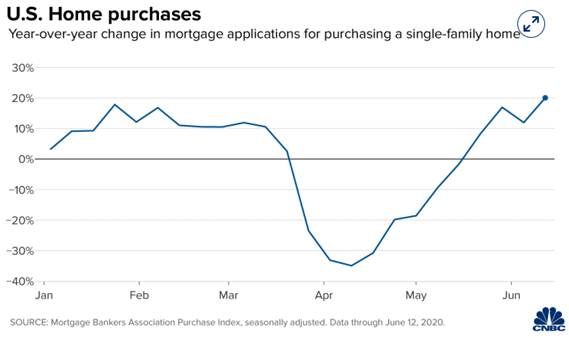

o Mortgage applications for buying a single-family home are now up 21% compared to last year as mortgage rates drop to record lows. (Mortgage Bankers Association)

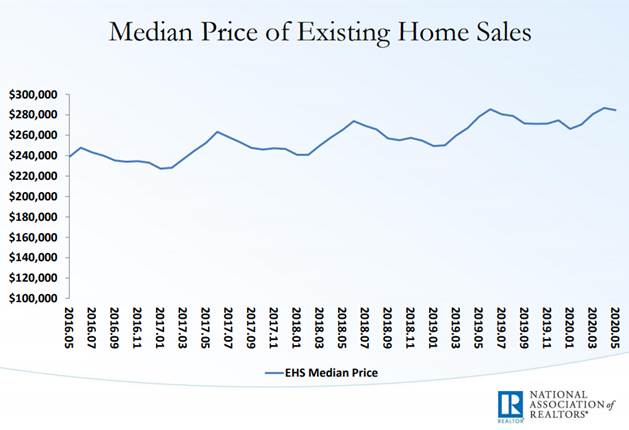

o The median existing-home price in May was $284K, up 2.3% from May 2019, as prices increased in every region. May’s national price increase marks 99 straight months of YoY gains. (National Association of Realtors)

o Total housing inventory at the end of May totaled 1.55 million units, up 6.2% from April, and down 18.8% YoY.

o According to the NAR’s chief economist: ““New home construction needs to robustly ramp up in order to meet rising housing demand. Otherwise, home prices will rise too fast and hinder first-time buyers, even at a time of record-low mortgage rates.”

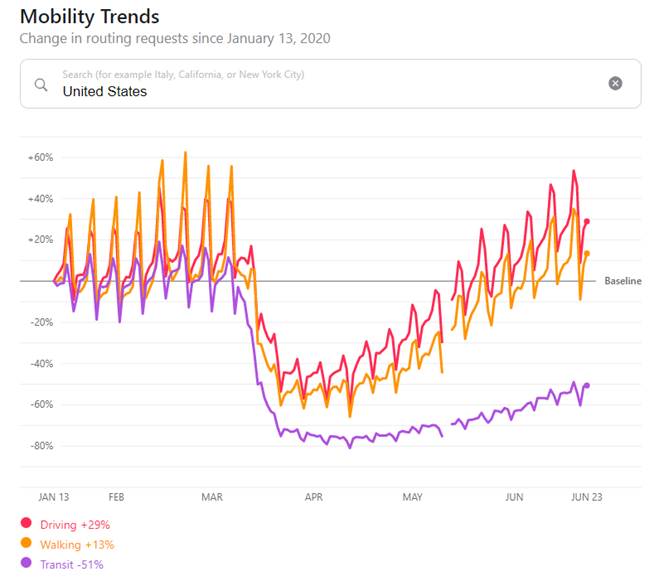

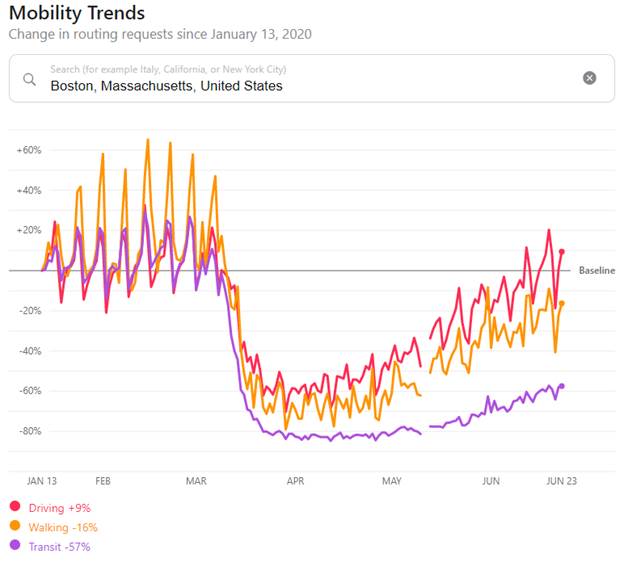

· And one measure of overall activity that is kind of interesting…according to Apple, driving and walking directions are up while transit remains way down. The data is available on their site by different geographies… https://www.apple.com/covid19/mobility

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$BKI.US

[tag BKI]

$SHW.US

[tag SHW]

$HD.US

[tag HD]

[category equity research]