On 7/23, Travelers reported a Q2 EPS loss of $-.20, in-line with expectations. Results were hit by catastrophe losses for storms and civil unrest. Losses related to the pandemic continue to be small (-$50m) partially offset by lower auto incidents. Positives for the quarter were improving underlying margin improvement and continued strong pricing gains.

Travelers is a high quality, disciplined underwriter of insurance that is focused on returning capital to shareholders through dividends and share buybacks.

Current Price: $118.61 Price Target: $120

Position Size: 1.56% TTM Performance: -18.3%

Thesis Intact. Key takeaways from the quarter:

- Despite cat losses, core business results were solid

· Combined ratio ex-cats of 91.4% ahead of expected 96.3%

· Net premiums declined -1%, again ahead of expectations and not bad given environment

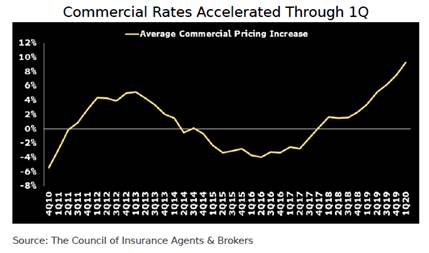

· Strong pricing with renewal premiums up 2.5% to 7.8%. The industry has faced several headwinds – higher cat losses, negative tort trends and falling yields. As a result industry wide pricing has been strongest in 10 years:

- Net Investment Income fell $24m due to lower rates. Non fixed-income investment results were down $-180m as these are reported with a lag of one quarter.

- Strong financial position

- Debt to capital ratio of 23.2%

- Most of debt is long term – just issued a 30yr bond yielding 2.5%

- 97.9% of fixed income portfolio is investment grade with average rating of AA

- Strong rankings from rating agency relative to peers

- Debt to capital ratio of 23.2%

- TRV yields 2.87% – for Q2 2020 TRV did not buyback any share which is the first quarter in 10+ years.

- First quarter in 10+ years that they did not buyback shares – Many financial companies have delayed share buybacks given optics of current environment

- Over past 10 year shares outstanding have fallen 53%!

- Management has a long history of employing capital wisely! Instead of investing in mature business with spotty pricing, they are returning excess capital to shareholders

- First quarter in 10+ years that they did not buyback shares – Many financial companies have delayed share buybacks given optics of current environment

5. Current valuation of 12.3 P/E is close to historical mean. Price target represents 12x 2021’s estimated earnings.

The Thesis on TRV:

- We expect TRV will be able to grow book value per share in the mid-single digits over the near-medium term, and generate ROE in the 10-14% range

- Industry leader with disciplined underwriting and investment portfolio track record

- Consistent returns in the low to mid double digits

- Responsible capital allocation and proven desire to act in the best interests of shareholders

Please let me know if you have any questions.

Thanks,

John

$TRV.US

[category earnings ]

[tag TRV]

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109