Key Takeaways:

· Organic sales +5.5%

o EM sales +2%

o Developed markets: +8%

o Hill’s pet nutrition +11.5% (are pets eating more now that their owners are with them all day?)

o E-commerce sales +50% overall; US +200%, Hills +50%

· Gross margin increased 120bps, operating margin up 30bps (increase in SG&A expenses was a negative)

· 2020 guidance not reinstated, most likely due to LatAm region uncertainty

· Priority given to debt pay down over share repo in 2H20 – but good news! share repurchase activity to return in 2H

Current price: $76.9 Price target: $82 (from $77)

Position size: 1.72% 1 year performance: +8%

Once again Colgate delivered good organic growth, still benefitting from the pandemic impact on consumers staying at home in Europe and North America (less so in emerging markets as their lower growth rate shows). We should expect some of that pantry loading to go away in 2H (assuming no major second wave hitting Europe/North America), and sales level stabilize in the lower single digits range. FX continues to be a drag (-6%) and is forecasted to remain a negative this year. Profitability has seen the benefit of both volume (+2%) and price increases (+3.5%).

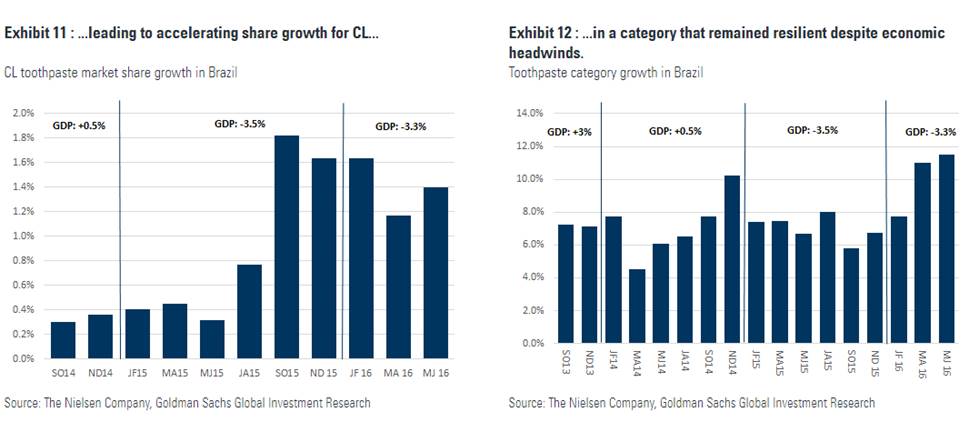

Colgate has a higher share of sales in oral care (58%) in the emerging markets (vs total company sales), and offers products in every price tier. So while Latin America struggles to recover from the COVID-19 crisis, likely impacting GDP growth, we can expect the consumers to trade down in price, which has been beneficial to Colgate in the past. During the last recession in Brazil, Colgate was able to gain market share in a pretty resilient category. The same happened in Russia (recession in 2015) and in Mexico (+170bps market share gain).

A testament of Colgate wide portfolio and resilient brands is its track record of positive organic growth, which has been positive every quarter but one since 2005.

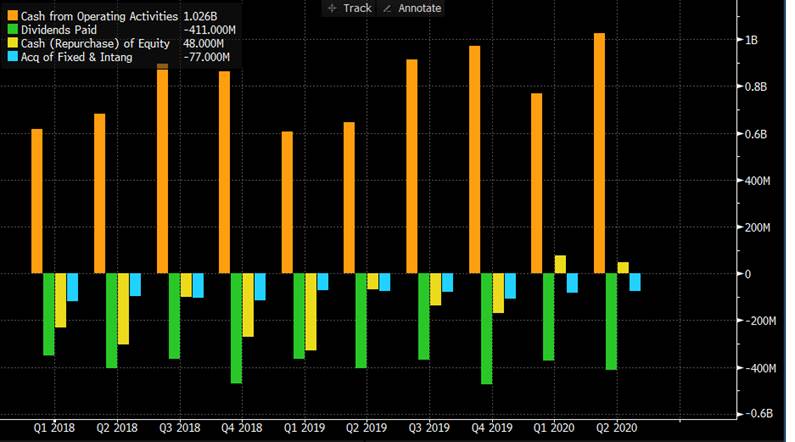

Colgate has good cash management, with cash flows covering capex, dividend and share buyback needs. We updated our model and raise our price target to $82.

The Thesis on Colgate

- High exposure to fast growing emerging markets (36% of Operating Profit from Latin America; 50%+ from EM)

- Defensive Product set (soap and toothpaste). Product line less vulnerable to trade downs due to low private label exposure in the categories

- Strong balance sheet (net debt/ebitda 1.4x) and highest ROIC in the sector

- 2.64% dividend yield

$CL.US [tag CL] [category earnings]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109