Key Takeaways:

· Good quarter with revenue up 10%, gross margin expansion of 60bps, operating profits up 24%

· Strong ventilator sales (~10% of company sales) offsetting some sleep slowdown (~90% of sales) due to COVID

· Gradual U-shaped recovery expected

· Stock is weak today as next couple quarters see lower demand in ventilators that were supporting growth, and masks/devices take time to recover – stock had been a strong performer YTD, consolidation not surprising (we trimmed on valuation/position size at the end of June)

Current price: $179 Price target: %179 (new from $168)

Position size: 3.58% 1-year performance: +56%

The company has manufactured 100,000 ventilators in 4Q, a rate we don’t expect to continue going forward. Resmed has partnered with Novartis, AstraZeneca, Orion and Boehringer on various inhalers. They now cover 90% of all inhalers in the US!

Software-as-a-service sales grew 7% this quarter, and is expected to keep growth in the mid-single-digits in the coming quarters as customers (mostly nursing facilities) struggle with COVID. The company accelerated the launch of its cloud-based remote monitoring software for ventilators across Europe, to allow doctor to remotely monitor patient’s conditions. The remote monitoring built into the devices pushed better compliance of usage by patients, and ability for clinicians to adjust the treatment. The greater push towards “value-based” reimbursement is also a trigger to get real feedback on treatment effectiveness.

Gross margin expanded 60bps thanks to product mix changes, partially offset by higher air freight costs. SG&A expenses went down 4% as the company saved on travel costs due to COVID-19.

The stock is down today as the tailwind from ventilator sales will fade in the coming quarters, combined with continued in-patient sleep labs below pre-COVID levels (~30% decrease in capacity). The management team reported a double-digit decline in new sleep patient diagnosis rate (COVID delaying doctor’s visits). Germany bounced back quicker (85% pre-COVID capacity), US at 70% while China behind at 50%. They are talking about a U-shaped recovery for their business. While in the US new patient starts is improving, the recovery is lagging expectations, on a stock that has performed very well YTD compared to peers. Their US resupply program with a recurring revenue stream is helping sales levels, providing some resiliency to revenue: around 80% of US mask growth comes from existing patients (not the case outside the US). In Western Europe and Asia, strict lock-downs, a smaller installed based, and payer constraints limits the resupply program (and thus masks growth this past quarter).

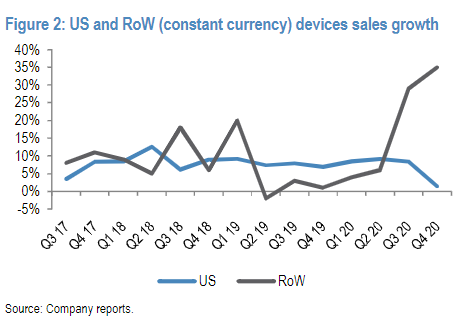

Outside the US, sales of ventilators lifted devices sales (+35%) thanks to contracts with national governments

Our long-term view on the stock is still valid, with the global sleep apnea market only ~20-30% penetrated, and market volume growth rate ~10% per year – an attractive market where Resmed and Philips play in duopoly. We are updating out estimate as we believe a recovery in FY21 will happen, and we roll forward our model.

FY21 guidance:

No gross margin expansion due to mix shift reversal and freight costs

SG&A to increase by low single digits

R&D growth in HSD to LDD

Tax rate 17-19%

Thesis on RMD:

- Leading position in the underpenetrated sleep apnea space

- Duopoly market

- New product cycle

- Returns of capital to increase: ~1% share buyback/year (back in FY18), dividend yield of 2%

$RMD.US

[category earnings] [category equity research] [tag RMD]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109