Key Takeaways:

· COVID-19 had less an impact on the US Companion segment than expected

· Sales up 4% organic (FX impact -4%):

o Companion animal +13% organic growth (US +19%, International +2%)

o Livestock -5% organic (US -18%, International +4%)

· Operating profit margin up 160bps

· Q3 launch of disruptive technology diagnostic platform (Vetscan Imagyst)

· Guidance raised due to Companion segment recovery

Share price: $161 Target Price: $177 NEW (from $156)

Position size: 2.27% TTM return: +30%

Zoetis released their 2Q20 results yesterday, with organic sales +4% organic (-4% FX impact), and a 4% increase in adjusted net income. Innovation was the driver of growth this quarter.

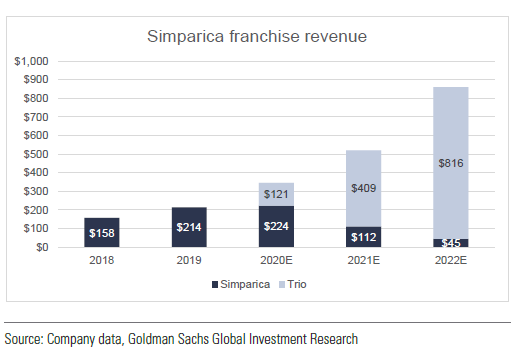

On the Companion Animal segment, their new drug Simparica Trio performed well in its full quarter of sales ($43M, vs. $15M in Q1 – with $100-125M targeted for the year), which was a pretty tough quarter for launching a new drug (limited rep sales, less vet visits). The drug also cannibalized less than expected the older Simparica drug, a positive surprise. Overall this segment recovered faster than expected from the Covid shutdowns.

US Livestock product sales came down as meatpackers faced Covid related supply chain and manufacturing disruptions, and the food-service industry struggled with lockdowns. The company is expecting that this segment will remain under pressure throughout the rest of the year. The international livestock performed better as the diversity of the animal base mitigated some of the pressure.

The company is launching a new diagnostic system for in-clinic use called Vetscan Imagyst. This tool will use a combination of image recognition technology, algorithms and AI to deliver rapid detection of harmful parasites in pets. ZTS will charge a fee per read for each sample. This new toll will be launch towards the end of Q3 2020.

The resiliency of their pet business and ability to push innovation in the market were shown this quarter, and in our eyes justifies the premium valuation of the stock. We are raising our price target following a good quarter.

Guidance for 2020:

Revenue up 3%-6%

EPS $3.52-$3.68 from May guidance of $3.17-$3.42

Zoetis investment thesis:

· Attractive industry profile: mid-single-digit growth rate, little generic threat, cash payers, pet sub-sector is very fragmented

· ZTS is a leading diversified animal pharma company that continues to innovate to fulfill unmet animal needs

· ZTS is growing above the industry rate and has proven resilient throughout economic cycle

· Experienced management team has proven successful in increasing revenue and margins since the IPO in 2013

· Good capital allocation strategy: M&A and capex spending have lifted sales and improved profitability

$ZTS.US

[category earnings] [tag ZTS]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109