TCPNX Commentary – Q2 2020

Thesis

TCPNX is a smaller fund that does not have as many assets under management compared to our other core mangers, enabling them to make more nimble and tactical decisions. By making small allocations to undervalued “riskier” asset classes (high-yield and non-dollar denominated debt), TCPNX diversifies our fixed income portfolio and generates superior returns to the benchmark (Barclays U.S. AGG). We like that the fund utilizes a bottom-up investment process through proprietary framework analysis, fundamental security review, and portfolio risk management.

[more]

Overview

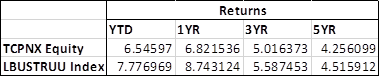

In the second quarter of 2020, TCPNX outperformed the benchmark (Barclays U.S. AGG) by 61bps. The overweight to spread sectors were the largest contributor to performance. Allocation to other asset classes such as securitized credit also helped performance, while a neutral weight to credit relative to the index did not help relative performance much. Overall, the fund tends to invest in higher quality assets which were a headwind for this quarter, while low-rated, highly volatile bonds were stronger performers.

Q2 2020 Summary

– TCPNX returned 3.51%, while the U.S. AGG returned 2.90%

– Quarter-end effective duration for TCPNX was 5.80 and 6.04 for the U.S. AGG

– Three largest contributors

o U.S. Small Business Administration DCPC, Structure Settlements, and High Yield bonds

– The top detractors

o Airline Enhanced Equipment Trust Certificates, U.S. Treasury STRIPS, and long duration Multi-Family CMOs

Optimistic Outlook

– We continue to hold this fund and believe in our thesis due to the fund’s consistent and defensive approach that we expect to generate alpha through times of low volatility

– The fund believes that Fed involvement will keep the economy and market afloat and positive, yet if this support fades then the future could be very volatile

– TCPNX is focusing on increasing quality names – recently exited oil and exploration companies

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109