WATFX Commentary – Q2 2020

Thesis

WATFX is an actively managed fund that finds overlooked areas of the market that can go against consensus views and add value. Through internal macro, credit, and fundamental research WATFX identifies undervalued securities and takes on more credit exposure to generate alpha over time. Through a diversified approach to interest rate duration, yield curve, sector allocation, and security selection, the fund dampens exposure to volatility.

[more]

Overview

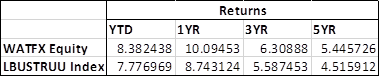

In the second quarter of 2020, WATFX outperformed the benchmark (Barclays U.S. AGG) by 275bps. The allocation to investment grade corporate bonds contributed most to overall performance. EM debt, non-Agency RMBS, ABS, and TIPS also helped contribute to returns. Lastly, the fund’s duration, which is longer than the benchmark, also helped add to performance. The overall narrowing of spreads through numerous fixed income asset classes helped WATFX outperform the benchmark.

Q2 2020 Summary

– WATFX returned 5.65%, while the U.S. AGG returned 2.90%

– Quarter-end effective duration for WATFX was 6.8 and 6.04 for the U.S. AGG

– Lengthening of duration

– Reduction to the MBS space due to tightening spreads from Fed action

–  Increasing allocation to investment-grade corporate bonds

Increasing allocation to investment-grade corporate bonds

Outlook

– We continue to hold this fund and believe in our thesis due to the fund’s diverse approach and strong top down-bottom up fundamental value investing over the long-term

– WATFX is expecting a longer “U-shaped” global economic recovery

o The near-term shortfall will fade as policymakers continue to push for economic activity through stimulus packages

– The fund is excited to seek out opportunities as spreads widen and the Fed continues to support corporate credit markets

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109