HLMEX Commentary – Q2 2020

Thesis

HLMEX utilizes fundamental research to find companies with strong quality and growth metrics that can be compared across the global landscape. By focusing on investments with competitive advantages, long-term growth potential, quality management, and corporate strength, HLMEX offers diversity to our EM allocation while generating alpha over the long run. We continue to hold the fund because of the team’s conviction in high quality companies and managed risk through diversification and evaluation.

[more]

Overview

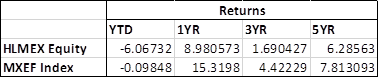

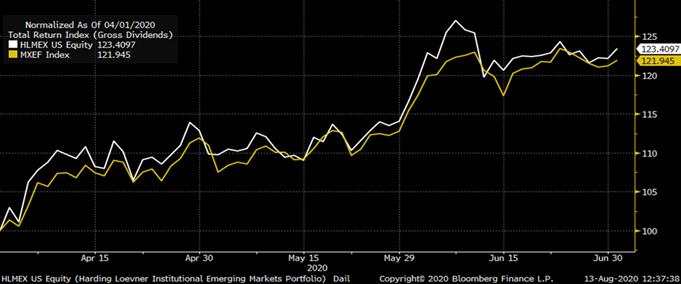

In the second quarter of 2020, HLMEX underperformed the benchmark (MSCI Emerging Markets Index) by 58bps largely due to an underweight allocation to China and Hong Kong. Stock selection in Information Technology, Health Care, and Consumer Discretionary also detracted from returns. Industrials and strong selection in Financials did help offset these losses, though. Regionally, India, Peru, and Thailand detracted from performance, while China contributed to returns.

Q2 2020 Summary

– HLMEX returned 17.50%, while the MSCI Emerging Markets Index returned 18.08%

– Underweight to China and Taiwan – 35% cap which was established in 2016

– Contributors

o Techtronic Industries (Industrials), GF Banorte (Financials), & Sberbank (Financials)

– Detractors

o CSPC Pharmaceutical Group (Health Care) & Sands China (Consumer Discretionary)

– One purchase this quarter – AirTAC (Taiwanese manufacturer of pneumatic equipment)

– One sale this quarter – Hankook Tire (South Korean company in Consumer Discretionary)

Outlook

– We continue to hold this fund and believe in our thesis due to the fund’s focus on quality by emphasizing earnings growth and strong cash flow to gain attractive returns over the long run

– Over past year, portfolio has shifted from being overweight in expensive stocks to underweighting this area – has created a headwind for 2020

– Continue to invest in durable growth – quality focus with attractive valuations

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109