Key Takeaways:

· Quarterly organic sales decline 17%y/y on a comparable basis, better than expectations, showing a faster recovery than modeled earlier in the Covid crisis

· Renewed focus on top line growth:

o early signs of market share gains due to new product launches, focus on innovation

o Pace of tuck-in M&A expected to accelerate (3 recently)

o Cultural changes within the sales team as well: market share gains are now part of their metrics in FY22

Current Price: $104 Price Target: $121

Position Size: 2.72% TTM Performance: -1%

Medtronic released its quarterly earnings with a beat vs. expectations. Last quarter, sales expectations were for a worsening of the situation (lower than -25%) but the company achieved a (17%) – still a big decline but showing a faster recovery of the business (in Cardiac/vascular and Restorative Therapies). With 52% of sales coming from the US – down in the low 20% vs the rest of the developed countries in the mid-single digits to mid-teens decline – Medtronic is affected by the high rate of COVID still impacting the US. The situation continues to evolve of course: Europe is back to seeing climbing cases and imposing some restrictions again. We still don’t have any guidance for the FY2021 year, but with so many moving pieces, this is not surprising.

During the video call (a first!), CEO Geoff Martha – on the job since the end of April – sounded particularly positive regarding the company’s renewed focus on top line growth, thanks to their broad innovation pipeline and recent share gains. There seems to be interest in accelerating the number of smaller acquisitions (most recent 3 added to $1B spent), as their balance sheet allows them to.

· In the Cardiac/Vascular segment, sales were helped by the new Micra technology(transcatheter pacing system) and Cobalt and Crome platform (defibrillators), helping the company gain market share, and regaining share in TAVR.

· The Minimally Invasive Technology segment was helped by the sales of ventilators (sales doubled y/y). Ventilators production increased to 1,000/week to meet demand. Emerging markets are currently driving the demand.

· In Restorative Therapies, MDT is gaining share in Spine products, and the pending acquisition of Medicrea should push gains even more, expanding the offering with AI technology to personalized spine implants.

· The diabetes segment (the smallest in revenues) has been a drag on MDT results for a while now. This quarter it was impacted by a delay in the new pumps in the US and continued competitive pressure. But there seems to be some light at the end of the tunnel: the Blackstone partnership and the Companion acquisition are positive news for this franchise. Companion Medical is the manufacturer of the InPen product, the only FDA approved “smart” insulin pen integrated with a diabetes management app. The Blackstone partnership provides funds to accelerate 4 R&D projects.

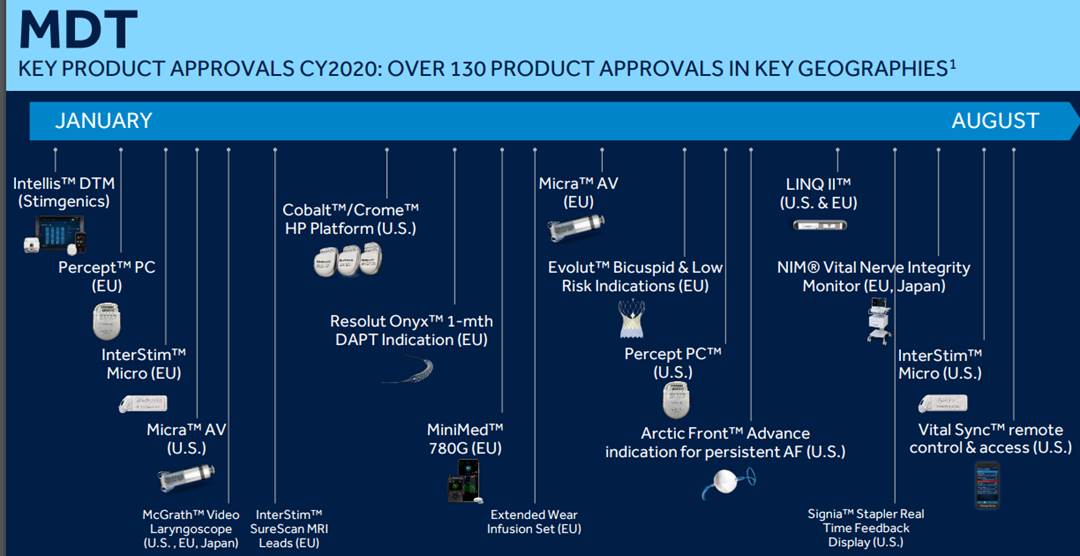

While margin expansion is possible, this will be kept to a minimum in the near term, as the management team puts efforts into R&D spending to drive future top line growth. Since the beginning of the year, 130 new products have been approved worldwide. Those new products have helped MDT gain 100bps of market share in the US in its heart business.

Overall we thought the tone of the call was positive and we hope to see some continued market share gains in the coming quarter, thanks to a renewed focus by the leaders on driving top line growth.

MDT Thesis:

· Stands to benefit from secular trends (1) increased utilization from Obamacare (2) developed populations age

· Strong balance sheet and cash flows. Increased access to non-cash should allow MDT to meaningfully increase their dividend

· 6% normalized Real Cash yield provides solid total return profile over next 2-3 years

· Ownership interest aligned. Management incentivized to maximize shareholder returns – 14% 10yr average ROIC

Category: Equity Earnings

Tag: MDT

$MDT.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109