Current Price: $127 Price Target: $165

Position size: 1.5% TTM Performance: -9.5%

Key Takeaways:

· Miss on revenue, but big beat on EPS as cost cutting and lower sports programming amortization mitigated losses from park closures.

· Strong Disney+ performance – Overall, Disney+ continues to ramp better than expected w/ 60.5m subs currently. June 30 quarter end sub number (57.5m) was below expectations (59m), but current number is ahead.

· Growing DTC plans – trialing pay-per-view DTC premier for Mulan in place of theaters, launching a Star-branded DTC service in international markets in calendar 2021 and planning an upcoming investor day related to DTC plans.

Additional Highlights:

· Revenue was $11.8B vs $12.4B expected. Despite revenue down 42% YoY, driven largely by an 85% YoY drop in Parks segment revenue, Disney managed to post positive op income and FCF for the quarter. Op income was ~$1B vs expectations of about -$900M loss.

· Collectively, management estimated COVID-19 had a net adverse op income impact of $2.9B, which was felt most in Parks segment. They were able to offset this across the business w/ cost cutting.

· Overall, a very encouraging and upbeat call with an upcoming investor day in the coming months that mgmt. seemed very positive about. They’ll likely update Disney+ profitability guidance given it’s tracking way ahead of original targets. Additionally, the long-term speculation has been for a DTC model for ESPN – so this could be a potential topic.

· Media:

o Media Networks revenues for the quarter decreased 2% to $6.6 billion, and segment operating income increased 48% to $3.2 billion. Op income was up in Q3 due to higher results at both Broadcasting and Cable.

o Broadcasting op. income was up due to lower programming and production costs, an increase in affiliate revenue, higher program sales and lower marketing costs. These increases were partially offset by lower advertising revenue.

o Cable op income up due to increases at ESPN and FX Networks. ESPN benefited from lower programming and production costs and, to a lesser extent, higher affiliate revenue, partially offset by lower advertising revenue. ESPN’s lower programming costs were due to the deferral of rights costs for the NBA and MLB. The rights costs will be incurred as games are played in future quarters.

o Several live sporting events have already returned to ESPN this quarter including Major League Soccer on July 8, Major League Baseball on July 23, and the NBA last Friday.

· Parks, Experiences and Products:

o Segment revenues decreased 85% to $1B, and segment op income decreased $3.7B YoY to a loss of $2B.

o They are seeing a positive net contribution from re-opened parks in Orlando and Shanghai. Phased reopening of Shanghai, Paris, Tokyo, and Orlando, as well as the shopping and dining area at Disney Anaheim. Hong Kong opened then closed after less than 1 month due to government order.

o Florida performing below expectations due to second wave of Covid, but still a positive net contribution. Shanghai performing better than expectations.

· DTC:

o Between Disney+, ESPN+, Hulu they now have >100m paying subs.

o Int’l Star launch – in lieu of Hulu int’l. Will be a general entertainment offering under the Star brand in calendar year 2021. Primarily owned content from ABC Studios, Fox Television, FX, Freeform, 20th Century Studios and Searchlight.

o 60m subs at Disney+ was originally targeted for 2024, so they hit their 5 year target in about 8.5 months. And said they’re ahead of expectations in every geo, with big launches still ahead. They said India is 15% of subs. ARPU is $4.62, or $5.31 ex-India.

o They launch Disney+ in the Nordics, Belgium, Luxembourg and Portugal in September, and in Latin America this November. And rolling out Disney+ Hotstar on September 5 in Indonesia, one of the world’s most populous countries. By year-end, Disney+ will be available in 9 of the top 10 economies in the world.

· Studio:

o Op income decreased as higher TV/SVOD distribution results, lower home entertainment marketing costs and lower film impairments were more than offset by lower theatrical distribution results. No significant titles released in the quarter. Lapping comparison of Avengers End Game from last year. No new TV and film production since March.

o With Mulan they are primarily skipping theaters b/c of closures and going direct to platform on pay-per-view basis @ $30. This highlights their alternatives in their studio business. While studio has been a very profitable segment and is their content R&D factory, w/ DTC they can pivot on distribution and do so profitably. While they have no current plans to abandon the theater model and are considering this a test case, it’s important that they have options.

o They need lower household penetration w/ DTC to be channel agnostic. With theater distribution, there is heavy marketing spending and their box office take rate is 45-50%. This is higher than other studios b/c of their clout w/~40% box office share and a heavy slate of blockbuster titles. So they would need to generate less than half the revenue w/ DTC release than theater release to achieve the same revenue. And the $30 per household grosses up to >$60 at the theater which is higher than typical household theater/movie spend, so from a household penetration perspective it would be even lower than 50% to be even. Additionally, a DTC launch could spur additional subs which have far higher lifetime value than their net profit after a 45% take rate at the theater. Finally, sidestepping the movie theater and having the direct transaction w/ the consumer gives them more data to drive other parts of their business…i.e. promos for consumer products or parks.

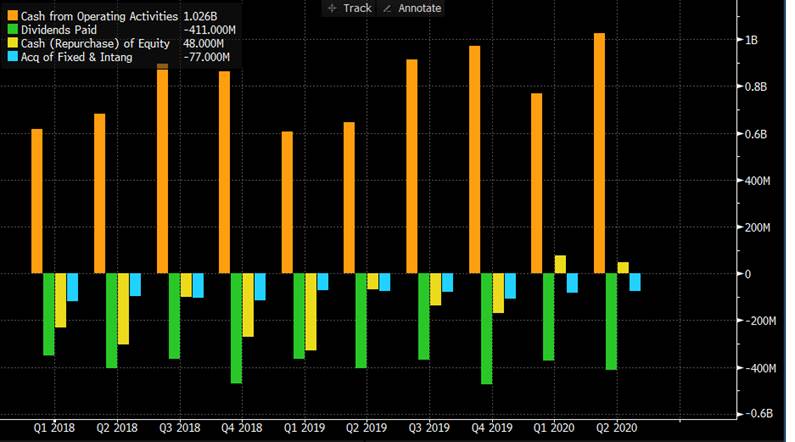

· Balance sheet remains strong w/ plenty of liquidity.

· No decision on dividend yet. Semi-annual and July dividend was suspended. They expect a decision in late Nov or early Dec.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

www.crestwoodadvisors.com

$DIS.US

[category earnings ]

[tag DIS]