Key Takeaways:

· Consumer segment: trend of eating more at home is now becoming a habit globally driving growth for this segment to +15%

o CEO quote: “Even before COVID-19 the consumers were cooking more at home. They were using more spices, and seasonings and sauces to prepare fresher healthier meals, they were moving to trusted and inherited brands. […]. The pandemic accelerated these trends and other trends like e-commerce that already underpin our strategies and that we were already capitalizing on”

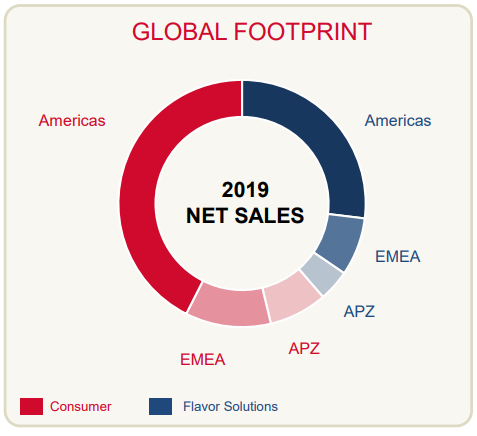

· Quick service restaurants are recovering strongly (but are lower margins), while other foodservice is slower to rebound which is a higher margin business (-1.1% decline in its Flavor solutions segment, especially in the Americas as Asia/Pacific had a +7% growth)

· Packaged food is returning to pre-Covid levels

· High demand in the US put pressure on supply chain, while EMEA and APZ had already built extra capacity

· Margins pressure from Covid related costs, and scaling up production/on-boarding people

· Guidance reinstated: organic sales 5% to 6%, flat margins, EPS growth of 6% to 8%

· Stock split 2 for 1 on 11/30/2020 (last one was 18 years ago) in order to provide greater liquidity

Current Price: $190 Price Target: NEW $202 (prior $191)

Position size: 3.15% 1-Year Performance: +24%

McCormick had another impressive sales growth of 8.6% this quarter, but this was shadowed a bit by the margin pressure, which should continue near term with Covid-related costs and additional capacity needed to meet higher demand.

In the Americas Consumer segment (its biggest in sales), the data points are encouraging, and supportive of MKC’s premium valuation, as its portfolio grew 28%, gaining share in 7 out of 11 categories, while household penetration and repeat buyers increased 8% and 7% respectively. Regarding the supply chain pressure in the US, the company is rapidly scaling up, and should meet demand by the end of the year.

Because the company continues to invest behind its brands, restocking shelves and restarting SKUs that were put on hold, the company believes it can produce positive growth in 2021 even with tough comps later in the year. While it is a bit early to talk about 2021 yet, the management team thought necessary to clarify some questions on the future growth of the company. Another positive this quarter was the early deleverage target of below 3X reached a quarter earlier than targeted, which can certainly open the door for acquisitions in the near term. We are updating our price target to reflect better 2020 sales numbers and increased scale providing a lift to margins longer term.

The Thesis on MKC:

• Industry Leader: McCormick & Company (MKC) is a leading manufacturer of spices and flavorings. MKC has been in business for 120 years and the founding family still has ownership interest

• Growth opportunity: Spice consumption is growing 3 times faster than population growth. With the leading branded and private label position, MKC stands to be the biggest beneficiary of this global trend

• Offense/Defense: MKC supplies spices to major food companies including PepsiCo and YUM! Brands giving it a blend of cyclical and counter-cyclical exposure

• Balance sheet and cash flow strength offer opportunities for continued consolidation through M&A in the sector

$US.MKC

[tag MKC]

[category earnings]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109