Key takeaways:

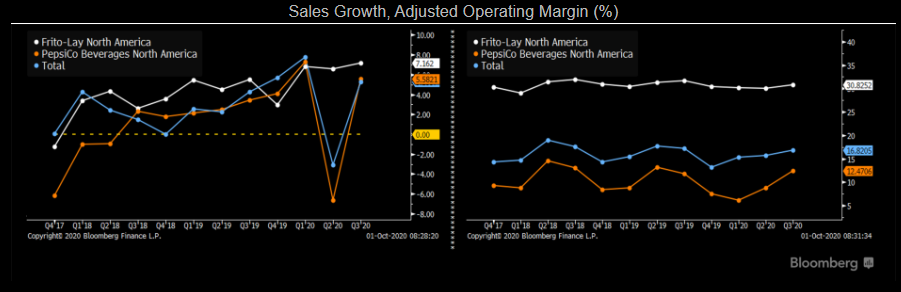

· Organic sales growth of +4.2% return to healthy levels, demonstrating the resilience of the diverse portfolio

· Productivity gains were offset by Covid expenses (a 80bps drag) and manufacturing automation and distribution systems investments – leading to a 40bps operating margin decline

· Financial guidance restored for 2020:

o Organic sales growth of 4%

o EPS of $5.50 (only 3 cents below 2019)

Current price: $140 Price target: $153

Position size: 2.14% 1-year performance: +1%

Pepsi released its 3Q20 earnings this morning. Organic sales of 4% shown a return to normal levels for the company, which is encouraging, as part of its business remains impacted by the pandemic (restaurants for example). In the US, its snack business grew 6%, while Quaker Foods continues to benefit from the pandemic trend of eating at home (+6% sales growth). Europe grew an impressive +7% Asia/Pac +5%, but Latam posted a small +1% growth and Africa, Middle East and South Asia decline 2%. The rising unemployment is having an impact in those regions, although Pepsi believes it has enough of a sizing/pricing playbook to offset some weakness in the emerging markets. On the beverage side, the integration of the new energy drink Rockstar acquisition and distribution agreement with Bang is going well. The work from home trend is also benefitting SodaStream (double digits revenue growth) as consumers enjoy the convenience of making sodas at home. This trend also impact their energy drink category (Gatorade, the market leader), as people get into a routine of working out at home more and indulging in those drinks.

On the margin front, we shouldn’t expect any expansion near term as Covid expenses remain a reality.

As we near the end of the year, the management team reintroduced its 2020 guidance, which we find reassuring. Sales growth of 4% is good in today’s environment.

Thesis on Pepsi:

- Global growth opportunity with about 40% of profits coming from outside the US. CSD is only 25% of sales (and Pepsi brand only 12%)

- Strong market share in high growth emerging markets where there is low penetration and rising per capita consumption

- Resilient snack business provides pricing power and visibility to future cash flows (more than half of sales are from snacks not beverages). CSD is only 25% of sales (and Pepsi brand only 12%)

- Several Great brands driving global growth: Frito Lay, Quaker, Gatorade

- Strong balance sheet and cash flows support a solid dividend yield and share buyback program

Tag: PEP

category: earnings

$PEP.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109