Key Takeaways:

Current Price: $61.4 Price Target: $72 (NEW – down from $78 on VNT divestment)

Position Size: 1.88% 1-year performance: +8%

- Sales recovered quarter/quarter, to reach flat organic growth (+2.3% including acquisitions)

- Adjusted operating margins improved as well +140bps, leading to an 8% EPS growth y/y

- The ASP business (Advanced Sterilization Products) has seen a nice recovery: elective procedure volumes are back to ~90% of pre-COVID levels in North America; and to ~95% in both China and Europe – However in Japan, they have seen a reduction in elective surgeries with the resurgence of cases – something to watch for going forward with our medtech names

- Software businesses providing resiliency, but still have some Covid-related pressure (customer access & budgets)

Despite COVID, Fortive saw its sales jump 2.3% boosted by acquisitions, while margins increased nicely. Going forward, the company is focusing on adding more Software-as-a-Service businesses to complement its instrumentation products.

As for the use of cash, FTV remains committed to reducing its leverage and looking for M&A opportunities. We should expect additional debt reduction following the disposition of the 19.9% stake in Vontier (no date provided yet).

Q4 guidance is for a 0%-3% top line growth, and some margin expansion. Overall the quarter had no surprises, and we remain confident in FTV’s ability to generate shareholders returns over time. We are updating our price target to reflect the Vontier spin-off.

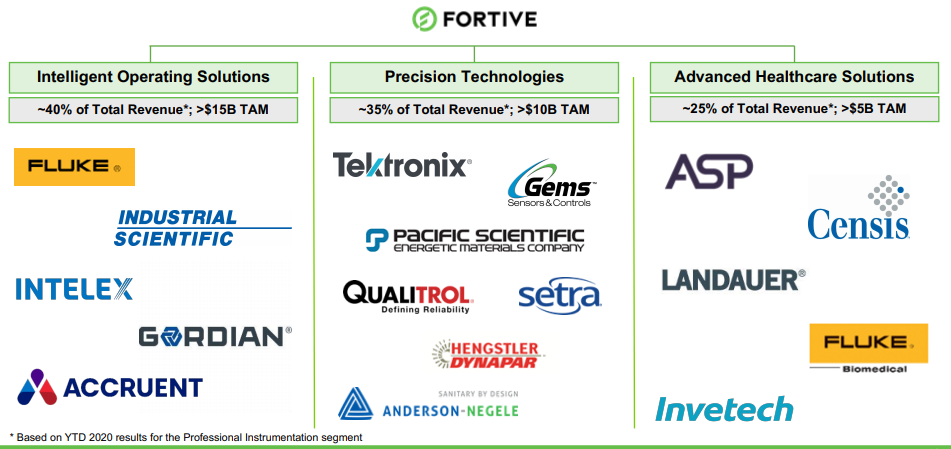

The company is updating its segments following the recent Vontier spin:

FTV Thesis:

- Market leader:

- Leadership position in most of the markets they serve

- Experienced leadership team

- Above industry margins with strong cash flows

- Quality:

- FCF yield ~5%

- Organic growth target of 3-3.5% (4-5% in last 2 quarters after being under the target in prior quarters)

- M&A strategy to enhance top line growth

- Margins expansion from new products introduction, continued application of the Fortive Business Systems and M&A integration

- Shareholder friendly:

- Management team focused on shareholder wealth creation through top line sustainability and margin expansion

$FTV.US

Category: earnings

Tag: FTV

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109