MWTIX Commentary – Q3 2020

Thesis

MWTIX is an actively managed fund that provides a sector-based strategy while still maintaining fundamental research driven through issue selection. When compared to the benchmark (Barclays U.S. AGG), the holdings have similar duration and exposure, yet selection is focused around areas where other managers are not looking. Through sector rotation and active weighting, we expect MWTIX to generate alpha over time.

[more]

Overview

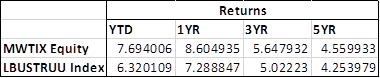

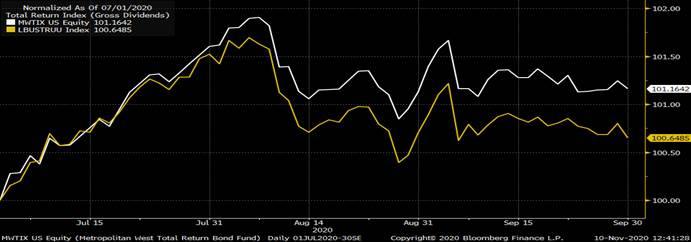

In the third quarter of 2020, MWTIX outperformed the benchmark (Barclays U.S. AGG) by 64bps, largely due to strong selection within corporate credit and residential MBS. The fund’s overweight to energy and finance companies helped contribute to higher relative performance, as well as a higher average yield. Exposure to non-agency MBS, ABS, and TIPS also added to relative performance. The fund’s duration – which is shorter than the index – had little impact on the returns as Treasury rates had mild changes during the quarter.

Q3 2020 Summary

- MWTIX returned 1.26%, while the U.S. AGG returned 0.62%

- Quarter-end effective duration for MWTIX was 5.58 and 6.1 for the U.S. AGG

- The fund has focused on allocating to higher quality products and securities

- Defense sectors make up the allocation in corporate credit and high yield

- Agency MBS have been swapped for TBAs

- A focus from ABS to AAA-rated CLOs and government guaranteed student loan collateral

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s defensive approach and minimal exposure to more vulnerable issuers and industries

- Pandemic data suggests that is will take a considerable amount of time for the economy to get back to its pre-COVID levels

- Behavioral changes and persistent labor market disparities will act as a headwind to a consumer-driven rebound

- Volatility will continue, especially with a delayed and potentially lower stimulus

- MWTIX has positioned itself to take advantage of relatively attractive prices during times of high volatility to generate strong returns

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109