TCPNX Commentary – Q3 2020

Thesis

TCPNX is a smaller fund that does not have as many assets under management compared to our other core mangers, enabling them to make more nimble and tactical decisions. By making small allocations to undervalued “riskier” asset classes (high-yield and non-dollar denominated debt), TCPNX diversifies our fixed income portfolio and generates superior returns to the benchmark (Barclays U.S. AGG). We like that the fund utilizes a bottom-up investment process through proprietary framework analysis, fundamental security review, and portfolio risk management.

[more]

Overview

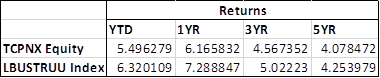

In the third quarter of 2020, TCPNX outperformed the benchmark (Barclays U.S. AGG) by 54bps. The overweight to spread securities and underweight to U.S. Treasuries positively added to returns. An overweight to U.S. Agencies and Agency Multi-Family MBS, and underweight to Agency Single-Family MBS, helped contribute to performance. Underweight to CMBS and general allocation to higher quality credit and secured debt created a headwind.

Q3 2020 Summary

- TCPNX returned 1.16%, while the U.S. AGG returned 0.62%

- Quarter-end effective duration for TCPNX was 6.0 and 6.1 for the U.S. AGG

- Three largest contributors

- Small Business Administration Development Company Participation Certificates, airline Enhanced Equipment Trust Certificates, and High Yield bonds

- The top detractors

- Municipal debt and Title XI bonds

Optimistic Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s consistent and defensive approach that we expect to generate alpha through times of low volatility

- The fund believes the decline in the recovery outlook is largely correlated with the lack of a stimulus deal

- Tight credit spreads and high levels of economic uncertainty will create challenges for the fund to find opportunities

- “Lower for longer” rates stated by the Fed has created opportunities in U.S. Agency debt

- TCPNX is focusing on increasing quality names – recently exited oil and exploration companies

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109