AFVZX Commentary – Q3 2020

Thesis

AFVZX is our only active manager in the large cap U.S. equity markets and applies a quality and value tilt to their investment strategy, holding roughly 50 companies. By utilizing DCF models, bottom-up fundamentals, and holding sector weights that are equivalent to their benchmark (S&P 500 Index), the fund generates alpha over time purely through stock selection. We continue to hold AFVZX because of the team’s ability to compare stocks across all sectors which enables them to generate strong returns over the long run.

[more]

Overview

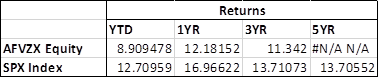

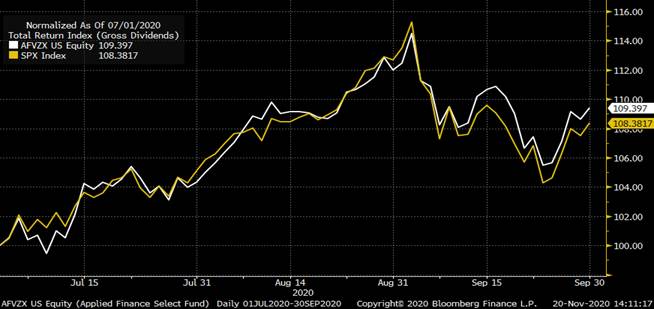

In the third quarter of 2020, AFVZX underperformed the benchmark (S&P 500 Index) by 42bps. 4 of the 11 sectors outperformed the index, while 7 underperformed. The fund’s value and small cap tilt helped deliver comparable returns to the S&P 500. Consumer Discretionary, Health Care, and Industrials were the strongest performing sectors, while Information Technology, Consumer Staples, and Materials detracted from returns.

Q3 2020 Summary

- AFVZX returned 8.51%, while the S&P 500 Index returned 8.93%

- Top contributors

- Consumer Discretionary – LOW, DRI, TGT all beat earnings expectations

- Health Care – TMO, DHR, SYK all benefitting from COVID

- Industrials – PWR and CMI

- Top detractors

- Information Technology – INTC and CSCO were worst performing technology stocks in sector for the fund

- Consumer Staples – WBA was the worst performer in the sector for the fund

- Materials – ECL due to institutional business challenges (hotels, restaurants, etc…)

Optimistic Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s ability to outperform the index over the long run through strong stock selection and maintaining a quality and value investment tilt

- The fund managers believe there is good reason for the market rebound

- U.S. Fed and Government involvement which is helping the economic recovery

- Auto and home purchases have seen a strong rebound

- Hopeful and encouraging vaccine news

- Near term, the fund is fairly optimistic, but is edging on the side of caution as flu season is around the corner and COVID concerns still exist

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109