Position size: 1.5% TTM Performance: -4%

Key Takeaways:

- Beat on revenue and EPS.

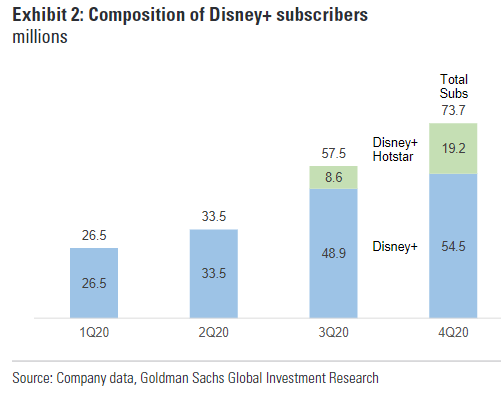

- Strong Disney+ performance continues – Disney+ continues to ramp better than expected w/ 73.7m subs above expectations of 65m.

- Accelerating transition to DTC first company – key driver of LT value for the company. Investor Day in early Dec will be devoted to this transition.

- Dividend still suspended, but plan for it to resume – This comes despite the investor letter from Third Point suggesting they permanently suspend it and channel that cash towards content. Leverage is still up, aiming to return to leverage levels consistent with single A credit rating.

Additional Highlights:

- Revenue was $14.7B vs $14.2B expected. Despite revenue down 23% YoY, driven largely by an 61% YoY drop in Parks segment revenue, Disney managed to post positive op income and FCF for the quarter. Adj. op income was $393m vs expectations of about -$1B loss.

- Financial results continued to reflect significant impacts from COVID-19 which adversely impacted segment op income by $3.1B. Parks, Experiences and Products segment was again the most severely affected with an estimated adverse impact of $2.4B in Q4.

- Segment re-alignment – Previously announced new segment reporting starts next quarter. This will essentially put all of their content creation together in a segment called “Media and Entertainment” and separate it from distribution. Currently, Studio, streaming and cable were in separate segments. The change separates optimal distribution decisions from the type of content made. This underscores a growing focus on streaming vs studio reliance and seems to suggest more movies going directly to streaming to drive subscriber growth.

- Overall, a very encouraging and upbeat call with an upcoming investor day in the coming months that mgmt. seemed very positive about. They will update Disney+ profitability guidance given it’s tracking way ahead of original targets. Additionally, the long-term speculation has been for a DTC model for ESPN – so this could be a potential topic.

- Media:

- Media Networks revenues for the quarter increased 11% to $7.2 billion, and segment operating income increased 5% to $1.8 billion. Op income was up in Q3 due to higher results at both Broadcasting, partially offset by lower results at cable networks.

- At Broadcasting, the increase in op income was primarily due to affiliate revenue growth and lower programming, production and marketing costs. The decrease in programming and production costs was largely driven by COVID-19 related shutdowns, the shift of college football games to fiscal 2021 and a delay in airing new season premieres. Lower results at cable networks were driven by decreases at ESPN, partially offset by increases at FX Networks and the domestic Disney channels.

- ESPN results were lower as affiliate and advertising revenue growth were more than offset by higher programming and production costs.

- Parks, Experiences and Products:

- Segment revenues decreased 61% to $2.6B, and segment op income decreased $2.4B YoY to a loss of $1B.

- “We’re very pleased with the dynamics we’re seeing at parks across the globe.” WDW was at 25% capacity…now at 35% capacity.

- Virus resurgence continues to drive closures – Paris re-closed recently. California still closed. Shanghai open for the full quarter. Hong Kong open for part of the quarter.

- All resorts operating at significantly reduced capacity. Walt Disney World, Shanghai Disney Resort and Hong Kong Disneyland all achieved a net positive contribution in Q4, which means they generated revenue that exceeded the variable costs associated with reopening.

- Positive demand signs – Walt Disney World already booked at 77% capacity for Q1. Thanksgiving week almost booked to capacity. In other words, there are some heavy fixed costs, but it pays to have them open despite really limited capacity.

- DTC:

- Revenues were +42% with an operating loss of $580m- an improvement of approximately $170m compared to the prior year. This improvement was driven by higher results at Hulu and ESPN+ partially offset by costs associated with the ongoing rollout of Disney+ and a decrease at our international channels. The improvement at Hulu was due to both subscriber and advertising revenue growth, partially offset by higher programming/production costs. The improvement at ESPN+ was due to subscriber growth and increased pay-per-view income from UFC events.

- Between Disney+, ESPN+, Hulu they now have >120m paying subs. ESPN+ subs were ahead of expectations at 10.3m vs consensus 9.1m. Hulu came in slightly below at 36.6m vs consensus 37.5m. Disney+ was 73.7m vs consensus 65m.

- Disney+ ahead of 5 yr. target after only 1yr. – 60m subs at Disney+ was originally targeted for 2024, so they hit their 5 year target in about 8.5 months. And said they’re ahead of expectations in every geo, with big launches still ahead. India plus Indonesia are ~25% of subs. ARPU is $4.52, or $5.30 ex-India. This is basically unchanged from last quarter. They will give updated subscriber targets at their Investor Day in December.

- Global rollout driving sub growth – Now in more than 20 countries worldwide. They launched Disney+ in the Nordics, Belgium, Luxembourg and Portugal in September, and in Latin America this November. Rolled out Disney+ Hotstar on September 5 in Indonesia, one of the world’s most populous countries. Disney+ will launch in Brazil, Mexico, Chile, and Argentina on November 17. By year-end, Disney+ will be available in 9 of the top 10 economies in the world.

- Studio:

- Studio Entertainment revenues for the quarter decreased 52% to $1.6 billion and segment operating income decreased 61% to $419 million. The decrease in operating income was due to lower theatrical and home entertainment results. Worldwide theatrical results continued to be adversely impacted by COVID-19 as theaters were closed in many key markets, both domestically and internationally, and no significant worldwide theatrical releases in the quarter.

- Production was heavily impacted by Covid except w/ animation which was uninterrupted. They’re finally re-starting production for live action films and television.

- Over time number of films and quality of content. New content adds subscribers. Increased pace in investment on content should be a focus at Investor Day.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$DIS.US

[category earnings ]

[tag DIS]