Key takeaways:

- Overall sales +22%!

- Beer sales increased by an impressive 28%, wine & spirits grew 13% organically

- Sales, margins and EPS came above consensus

- Hard Seltzer to double in capacity, as they are back to gaining market share following some Covid-related slow-down in production

- Currently only have 1 SKU, will launch another variety pack in FY22 (pineapple, strawberry, raspberry and passionfruit)

- New projects to be announced soon

- Lower end wine & spirits brands divestiture to Gallo finally closed – focus back on higher end wine & spirits and beer business

- New $2B share repurchase program authorized (in addition to the $1.9B remaining)

- Cannabis business remains an opportunity with Democratic win

Current Price: $230 Price Target: $255 (NEW)

Position Size: 2.65% 1-Year Performance: +22%

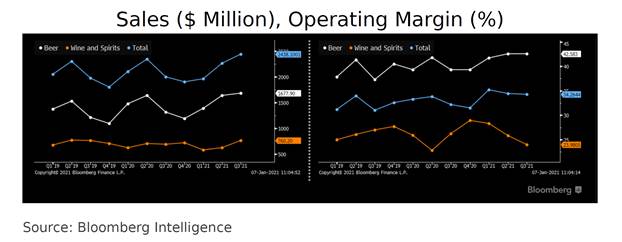

Company sales increased 22% this past quarter, showing its ability to grow nicely in the at-home consumption channel as COVID continued to impact bars & restaurant sales. Beer sales were up 28%, due to consumer demand but also catch up in inventory stocking from the prior quarter (now largely restored). The wine & spirit segment is seeing improvement (organic sales ~13%). Operating profit margins expanded 340bp thanks to leverage and timing of marketing spend. EPS was well above consensus numbers.

With the end of the fiscal year approaching, and good results this past quarter, STZ reinstated its FY 21 guidance: beer sales +7% to +9%, wine & spirits sales -9% to -11% (due to divestiture), operating profits +8% to +10% for beer, decline of -16% to 18% for W&S; EPS in the $9.80-$10.05 range.

Overall we are very pleased with the results, and raise our price target to reflect better W&S sales going forward as the focus is back on higher end brands, new projects in seltzer that should help STZ gain market share to reach #3 market share, and continued beer portfolio performance.

Investment Thesis:

- STZ helps position our portfolio to be more defensive at this stage of the economic cycle

- Management team focused on high quality brands and innovation

- STZ continues to have HSD top line growth and high margins that should incrementally improve going forward

- STZ comes out of a heavy capex investment cycle to support its growth: FCF margins are set to inflect thanks to lower capex

- Growth optionality from cannabis investment

[tag STZ] [category earnings]

$STZ.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109