Current Price: $31.5 Price Target: $36

Position Size: 2.76% Trailing 12-month Performance: -5.7%

Q3 Highlights:

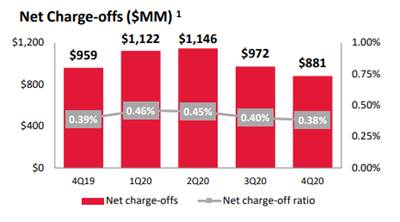

- Strong credit quality with credit loses reverting back to pre-pandemic levels and BAC released reserves for loan losses

- BAC actually released $858m reserves built up in anticipation for pandemic related losses, showing confidence in the recovery.

- Net charge-offs (loan losses) are back to pre-pandemic levels

- BAC has managed the pandemic well with strong credit performance.

- Largest deposit base in country with $885b in consumer deposits

- Deposit growth has surged up over 23% yoy

- Low cost source of funding. BAC pay only 4 bips on deposits.

- Net Interest income increased to $10.37b from $10.24b las quarter

- Net interest margin leveled off at 1.71% which they believe is the bottom

- Expect NIM to trend up as increased deposits are invested and balance sheet growth, though they noted reinvestment rates remain a headwind.

- NIM will remain depressed until we see a sustained economic recovery. At that point, banks will be among the industries most levered to benefit from the rebound.

- Excess capital – BAC is a return of capital story

- BAC has massive excess capital of $36B (13% of market cap) with a CET1 ratio of 11.9% which is 2.4% above required minimum

- BAC has approved a $3.2b share buyback for this quarter

- Current dividend yield is 2.28% for shareholder yield close to 7%.

- Fed’s stress test has consistently shown BAC losses to be lower than peers Strong capital ratios:

- Attractive valuation

- BAC has strong earnings power – generates over $5b a quarter in earnings

- BAC continues to build capital as share buybacks and dividend increases are restricted.

BAC Thesis:

- BAC has dramatically improved their Consumer Banking unit which has driven earning’s growth. Loss metrics are best among peers.

- Despite current recession, BAC has strong balance sheet and earnings power

- Their stronger capital position should lead to increased dividends and buybacks

Please let me know if you have questions.

Thanks,

John

[category Equity Earnings]

[tag BAC]

$BAC.US

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109