Key Takeaways:

Current price: $200 Price target: $236

Position size: 2.82% 1-year performance: +27%

- Top line growth of 7%, ahead of consensus of 5%

- Recovery in diagnosis level still below pre-covid in most markets

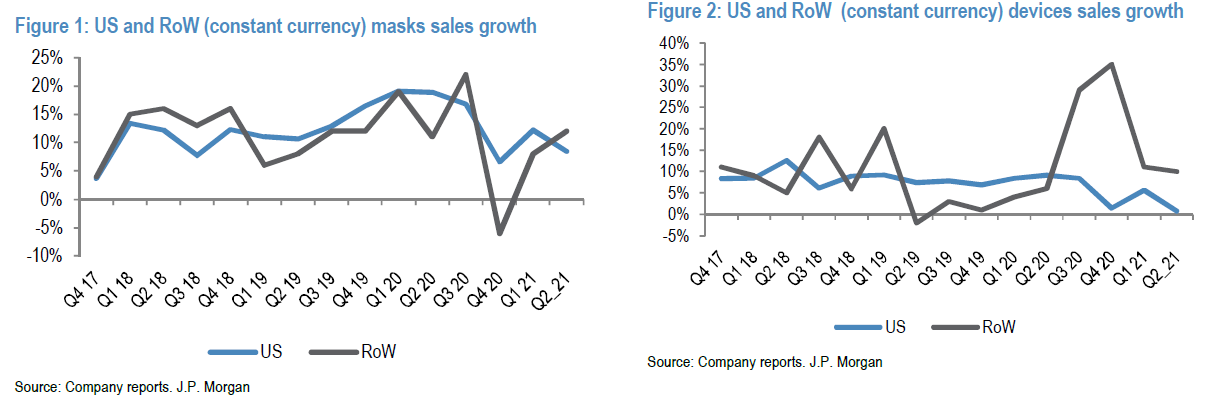

- Masks resupply is still elevated (+9% in US) – this represents 80% of US masks sales. Outside the US, masks sales were +12%, with a mix of resupply under the US level.

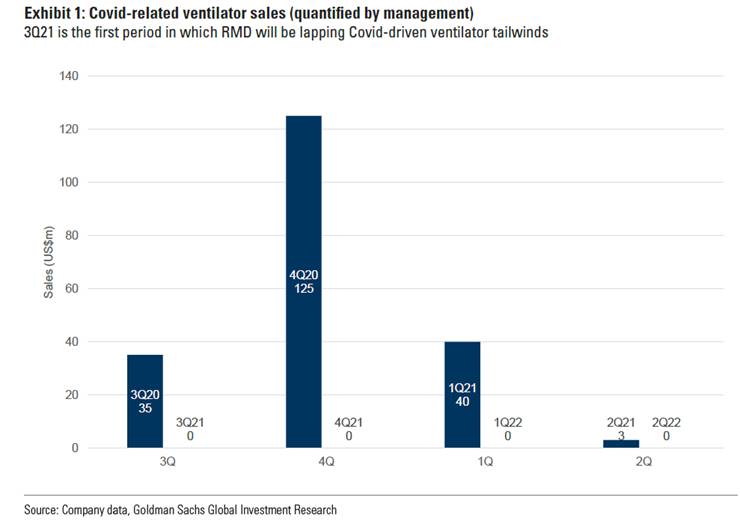

- Sale of ventilator for life support to hospitals is now behind them, we should not expect another high level of revenue from this business

- Home testing is a new trend, created by the pandemic (desire to avoid in center sleep testing). This dynamic could reduce barriers to sleep devices adoption thanks to greater convenience, and possibly lower costs

- Software-as-a-service business:

- growth in the mid-single-digit rate

- Covid impacted surgical procedures thus negatively affecting nursing homes/hospices attendance

- But recovery of home medical equipment and home health is even better

- Exiting the portable oxygen market (POC), as reimbursement policies in the US have not been favorable as expected when first entering this market in 2016. The POC market was a way to engage stage 2 and 3 COPD patients. But since, they acquired Propeller, gaining better access to COPD patients (including stage 1). What they have now is better than the POC market:

- The covid crisis has accelerated the adoption of high-flow therapy, which supports stage 2 and 3 COPD patients – this could become a large opportunity for them

- They now have a pharmaceutical drug delivery management offer (through Propeller) to support stage 1 and 2 patients

- Growing use of noninvasive ventilation and life support for stage 3 and 4

- Reviewing their supply chain resilience, including politics and trade relationships. They think as they gain scale, they will be able to face those headwinds better overtime

- The CMS announced that the Continuous Positive Airway Pressure (CPAP) industry will most likely escape reimbursement pressure through 2024

- We should expect some volatility in their sales level in the next few quarters, as the peak of sales of ventilators to hospitals has passed, but vaccine roll-out is not advanced enough to allow a return to normal sales level for their masks/devices

- Share buyback program is likely to start in the second part of 2021, assuming cash position continues to rise

- CEO quote: “COVID has highlighted the importance of respiratory health. COVID generally kills people through acute respiratory distress syndrome. And it’s awful, but that has raised the awareness of respiratory hygiene, respiratory health and the field of respiratory medicine. The crisis also showed us the importance of digital health and has accelerated the awareness and adoption of technologies that can be used for remote patient screening, for remote patient diagnosis, remote patient setup, as well as remote patient monitoring and management.

Our long-term view on the stock is still valid, with the global sleep apnea market only ~20-30% penetrated, and market volume growth rate ~10% per year – an attractive market where Resmed and Philips play in duopoly.

Thesis on RMD:

- Leading position in the underpenetrated sleep apnea space

- Duopoly market

- New product cycle

- Returns of capital to increase: ~1% share buyback/year (back in FY18), dividend yield of 2%

$RMD.US

[category earnings] [category equity research] [tag RMD]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109