WATFX Commentary – Q4 2020

Thesis

WATFX is an actively managed fund that finds overlooked areas of the market that can go against consensus views and add value. Through internal macro, credit, and fundamental research WATFX identifies undervalued securities and takes on more credit exposure to generate alpha over time. Through a diversified approach to interest rate duration, yield curve, sector allocation, and security selection, the fund dampens exposure to volatility.

[more]

Overview

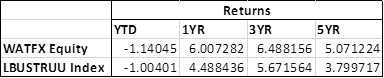

In the fourth quarter of 2020, WATFX outperformed the benchmark (Barclays U.S. AGG) by 132bps largely due to corporate credit positions and USD-denominated EM exposure. Lengthened duration, TIPS allocation, investment-grade corporates (and fallen-angels), agency MBS, structured products, and EM exposure all positively impacted performance. Poor yield-curve positioning was the only detractor during the quarter as yields began to steepen.

Q4 2020 Summary

- WATFX returned 1.99%, while the U.S. AGG returned 0.67%

- Quarter-end effective duration for WATFX was 6.9 and 6.22 for the U.S. AGG

- Trimmed investment-grade corporate credit exposure as spreads continued to tighten

- Trimmed TIPS exposure as 30-year breakeven inflation rates rose to highs

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s diverse approach and strong top down-bottom up fundamental value investing over the long-term

- Market have been rallying since the bottom in March – momentum will continue to carry the market forward

- COVID resurgence and slack in the global economy will keep volatility around

- The fund is excited to seek out opportunities as spreads widen and the Fed continues to support corporate credit markets

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109