REEIX Commentary – Q4 2020

Thesis

REEIX is driven through both top-down and bottom-up fundamental research that provides diversification within our full EM allocation. The fund looks for high quality companies across all market caps that have strong ESG scores. We like REEIX because of the consistent and repeatable process that allows the team to take advantage of companies with sustainable growth across all the Emerging Market (EM) landscape.

[more]

Overview

In the fourth quarter of 2020, REEIX underperformed the benchmark (MSCI Emerging Markets Index) by 291bps largely due to weak stock selection in China and Taiwan, although slightly offset by strong selection in Chile. Underweight to China was also beneficial to the fund’s returns. On a sector level, the fund’s selection in Information Technology detracted from returns, while selection within Financials benefitted performance. Allocation effect had no effect during the quarter.

Q4 2020 Summary

- REEIX returned 16.86%, while the MSCI Emerging Markets Index returned 19.77 %

- Contributors

- Chile and Financials

- Detractors

- China, Taiwan, and Information Technology

Outlook

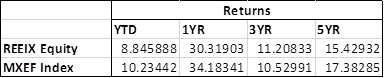

- We continue to hold this fund and believe in our thesis due to the fund’s historically strong returns and understanding of Emerging Markets on both a macro and micro level

- See potential for EM securities outperform the U.S. markets as the dollar weakens

- Federal Reserve’s aggressive balance sheet expansion

- Surge in U.S. fiscal deficit

- The majority of EM regions have been relatively more successful than developed countries when it has come to eliminating COVID

- Positive

- India, Mexico, Brazil, Chile, China, Consumer and Financial sectors

- Negative

- Latin America

- 5 focused themes

- Domestic consumption

- Health and wellness – long term beneficiaries due to COVID

- Digitalization – will get a boost from increased online migration and connectivity

- Financialization

- Infrastructure – added “Green Infrastructure” as climate change has become a larger conversation across firms

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109