TIAA-CREF Real Estate Fund Commentary – Q4 2020

Thesis

TIREX utilizes fundamental research to find properties in high barrier markets, with higher occupancy and rent growth. By focusing on quality companies and avoiding unnecessary risks, the fund obtains a strong track record that has outperformed the benchmark and REIT ETF over time. We continue to hold TIREX because of the team’s growth focus with asset concentrations in supply constrained markets. Lastly, TIREX was the lowest cost active manager screened, at 51bps.

[more]

Overview

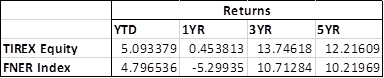

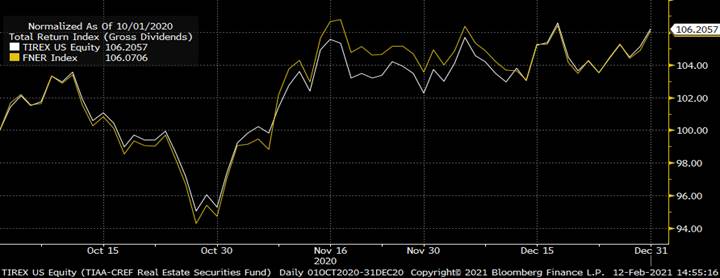

In the fourth quarter of 2020, TIREX outperformed the benchmark (FTSE Nareit All Equity REITs Index) by 20bps, driven by strong stock selection in the rebounding sectors such as lodging, and underweight to wireless cell tower REITs. These contributors were partially offset by an underweight to hard-hit industries that saw a strong bounce back in the fourth quarter – mainly office and shopping center REITs.

Q4 2020 Summary

- TIREX returned 8.35%, while the FTSE Nareit All Equity REITs Index returned 8.15%

- Contributors

- Allocation to AirBnB Inc. was the largest contributor

- This position was shortly sold due to its immense valuation expansion

- Underweight to Crown Castle International Corp.

- Allocation to Simon Property Group, Inc.

- Detractors

- Not owning Medical Properties Trust Inc. was the largest detractor

- Not owning Ryman Hospitality Properties Inc.

- Underweight position to Weyerhaeuser Company

Optimistic Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s goal to obtain long-term alpha through capital appreciation and current income

- By having a research-oriented investment process that focuses on cash flows and asset values we believe TIREX will continue to outperform its benchmark long-term

- The managers are effective when it comes to understanding and preparing for changes to the REIT landscape and where long-term sustainable growth exists

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109