Key Takeaways:

Current Price: $58 Price Target: $61

Position Size: 1.69% 1-year Performance: +64%

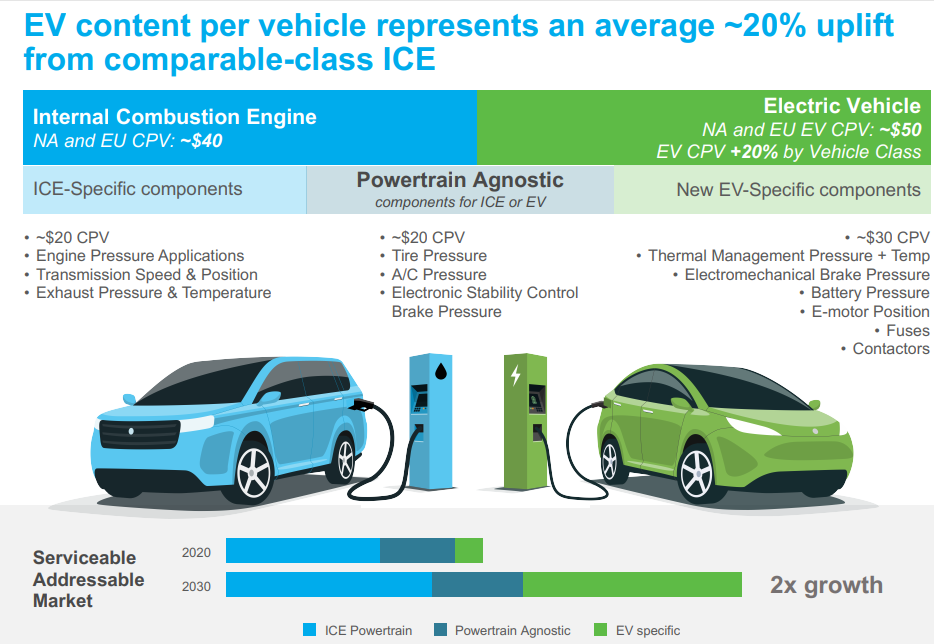

Overall results were good and the company is continuing on its growth trajectory, ex-Covid recovery, with its strategic acquisitions in the electrification theme, expanding its addressable market size quite meaningfully year after year.

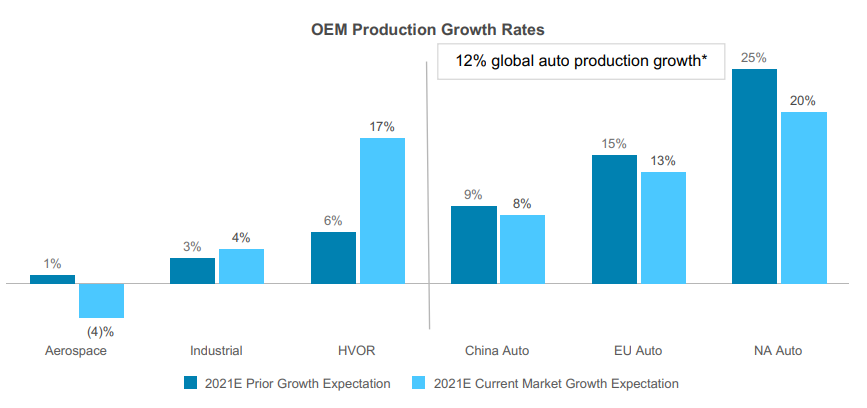

Sensata released its 1Q2021 earnings this morning. Total sales growth was +21.7% (organic sales were up 18.8%) and operating income margin expanded 330bps thanks to end-market recovery and outgrowth. The chip shortage/extra costs impacted margins by 120bps this quarter, while Covid related costs were 10bps. Looking at Q2, the company is guiding to have 58% to 63% organic revenue growth and a 750bps operating margin expansion y/y. For the whole year, guidance is for 16%-21% organic revenue growth and 230bps operating margin expansion. We believe the stock is trading down today as the management team is taking down their expectation for market growth in the following sectors: aerospace, China, European and North America auto production – mainly due to the global semiconductor chip shortage, which will weigh on their margin upside potential later this year. On the positive side, Heavy Duty /Off-Road vehicles and industrials were revised up.

Sales growth by segment:

- Automotive organic sales +19.3%: ST outgrew the market by 910bps

- HVOR organic revenue +32.8% y/y: outgrew the market by 1,070bps

- Industrial & other: organic revenue +16.8%

- Aerospace organic sales declined 22.4%

On the M&A front, ST acquired Xirgo Technologies, which will help them accelerate their ability to provide data insights to transportation and logistics customers. The cost of capital was reduced by 80bps (now 4.5%). Net leverage ratio was 2.9x at the end of March, but 3.4x including the recent Xirgo acquisition (closed on 04/01). They are also starting a joint venture with Churod Electronics extending their portfolio in electrical protection contactors. Sensata continues its growth in the electrification theme, which is much broader than just electric cars: charging infrastructures, industrial and grid opportunities as they expand in renewable energy. ST has a portfolio offer in high-voltage protection and battery management systems.

The Thesis on Sensata

- Sensata has a clear revenue growth strategy (content growth + bolt-on M&A)

- ST is diversifying its end markets exposure away from the cyclical auto sector over time through acquisitions, also expanding its addressable market size

- ST is a consolidator in a fragmented industry and still has room to acquire businesses

- Margins should expand as the integration of the prior two deals is under way, regardless of top line growth, and efficiencies in manufacturing are continuously pursued as they are gaining scale

- ST is deleveraging its balance sheet post acquisitions, leaving room for future M&A or a return to share buybacks, and improving EPS growth

Tag: ST

category: earnings

$ST.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109