Key Takeaways:

Current Price: $72 Price Target: $83

Position Size: 2.06% 1-year performance: +39%

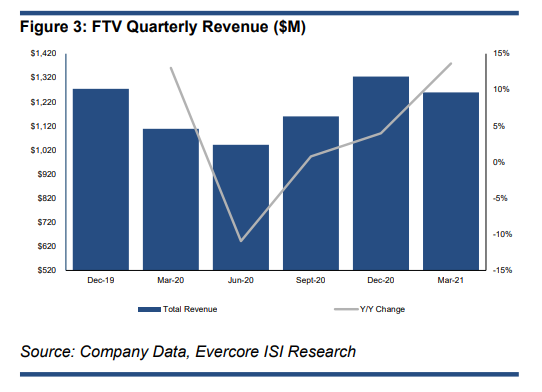

Fortive reported sales and EPS above expectations last evening, but guidance for 2Q and implied 2H21 growth rates are driving the stock down today. We think guidance is conservative due to limited visibility, and see 1Q a proof FTV has a portfolio of brands of quality.

- Organic growth of +9% (+13.6% reported includes FX and acquisitions)

o All three segments had positive sales growth:

Ø Advanced Healthcare Solution +11% organic (24% of revenue): high growth in China (+50%) for ASP. Elective procedure were 91% of pre-covid levels globally – reassuring for continued growth in coming quarters. Landauer (radiation safety) has grown its EBIT margin 2.5X since acquisition

Ø Precision Technologies +12% organic (36% of revenue): Tektronix had broad based growth in the low double-digits to mid-20% across geographies

Ø Intelligent Operating Solutions +6% organic (41% of revenue): broad strength in China for Fluke, expansion in Western Europe for Intelex, and overall better customer site access

o Software-as-a-service products had low double-digit growth

o Increased exposure to software and healthcare provides higher recurring revenue base, and sequential expansion as covid restrictions end

- Adjusted gross margin +90bps y/y, limited impact from higher commodity and logistics costs

- Adjusted operating margin +240bps

- Adjusted EPS $0.63, +37% y/y

- FCF $144M, +50% y/y, driven by strong earnings growth

Fortive has significantly reduced its leverage post Vontier spin-off:

- Net debt/EBITDA stands at 1.2X

- $5B in liquidity available

- We should expect some M&A back on the table

FY21 guidance:

- Organic growth raised to +7% to +10% (vs +4% to +7%)

- 2Q organic 16-19%, implies 2H21 slows down to 5-7%, which we think is due to limited visibility as we exit Covid

- Q2 quarter guidance is in-line with consensus expectations – margins would see 250bps impact from investments in growth projects and digital transformation

- Company could benefit from the proposed Infrastructure bill

- Adjusted operating margin of 22-23% (unchanged)

- Adjusted EPS raised to $2.50-$2.60 from $2.40-$2.55 (+20-24% y/y)

V-shaped recovery for FTV:

FTV Thesis:

- Market leader:

- Leadership position in most of the markets they serve

- Experienced leadership team

- Above industry margins with strong cash flows

- Quality:

- FCF yield ~5%

- Organic growth target of 3-3.5% (4-5% in last 2 quarters after being under the target in prior quarters)

- M&A strategy to enhance top line growth

- Margins expansion from new products introduction, continued application of the Fortive Business Systems and M&A integration

- Shareholder friendly:

- Management team focused on shareholder wealth creation through top line sustainability and margin expansion

$

FTV.US

Category: earnings

Tag: FTV

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109