Current Price: $52 Price Target: $58

Position size: 2.8% TTM Performance: 15%

Key Takeaways:

- Top line and EPS beat with better-than-expected revenue guidance. EPS guidance for next quarter was a slight miss driven by cost pressures from semi supply issues.

- Robust demand is key positive despite short-term headwind from chip shortages which are weighing on revenue and margins. If not for these semi supply chain issues, revenue and EPS guidance would have been higher.

- Secular drivers ramping – they are seeing early momentum in the ramping of key technology transitions (Wifi 6, 5G, 400 gig, edge) that are catalysts to companies modernizing their aging network infrastructure. They’ve been investing behind these big market transitions for a long-time, they’re finally starting to come to life and will be long-term growth drivers for their business.

- Mix shift to software and recurring revenue continues as an increasing number of their products are to be offered this way. They now have one of the largest software businesses in the industry with an annual run rate well over $14B, about 81% of that is SaaS.

- CEO Chuck Robbins said…“we are experiencing the strongest demand in nearly a decade” and “the next phase of the recovery and the future of work will be heavily reliant on our technology.”

Additional Highlights:

- Sales of $12.8B (+7% YoY) and EPS of $0.83 beat Street expectations ($12.57B and $0.82, respectively).

- Quotes from the call…

- “These results reflect a return to a strong spending environment and an economic recovery that has gained momentum driven by vaccine rollouts and the easing of restrictions. As the economy has improved, customers have increased their investment across our portfolio to prepare for the upturn and return to office.”

- “Customers are turning to us to help them create the trusted workplace of the future.”

- Supply chain issues & inflation – component availability is holding back revenue, they absorbed some cost increases to meet demand and started to make some limited price increases. They think this will last through the end of the calendar year – if it’s longer, they will look to make further price increases to offset. They don’t think the demand they’re seeing from customers is being impacted by over-ordering.

- Improving demand in hardest hit industries – “we’ve actually seen double-digit growth in hospitality and healthcare and retail and we’ve even seen the cruise lines making significant purchases as they prepare to go back out.”

- Growing mix of recurring revenue should expand their multiple –Software mix is close to 1/3 of revenue w/ 81% of software sold as subscription. That means over 1/4 of total sales is from software subscriptions sales (or ~$14B). Additionally, ~27% of rev is services with much of that from maintenance/support which tend to be recurring. So overall recurring revenue could be ~45% or more (they don’t break it out specifically). They have a growing “as-a-service” portfolio driving the mix shift happening w/in their business which should be supportive of their multiple and their margins. The majority of our total revenue growth in the quarter came from recurring revenue streams.

- Momentum w/ web-scale cloud providers – the positive commentary from last few quarters continued. Webscale was again ~25% of Service Provider orders, w/ order growth up 25%. This is an end market where they lost share to Arista in the past, but their positioning is improving w/ new products launched last year. That being said, this is still early stages – mgmt. indicated it may take a year or two for this to be a meaningful top line contributor. Could see performance vary quarter to quarter, due to the timing of large deals, but they are “incredibly confident” around their prospects in this area. Recently extended their webscale product offering – broadened their Silicon One platform from a routing focused solution to one which addresses the webscale switching market, offering the highest performance, programmable routing and switching silicon on the market.

- During Q3, they closed three acquisitions (Acacia Communications, IMImobile, Dashbase) consistent with their strategy of complementing R&D with targeted M&A to strengthen their market position growth areas.

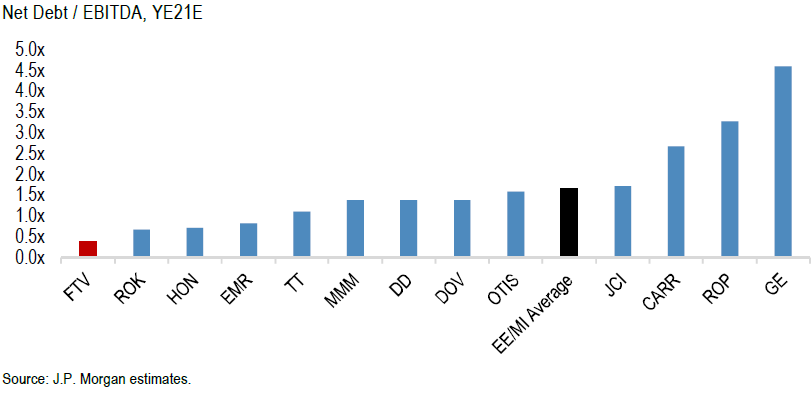

- Valuation: trading at >7% FCF yield on fiscal 2022, which ends in July. This is well below S&P average of ~4%, for a strong balance sheet, high FCF generative business (~30% FCF margins) w/ a growing mix of software and recurring revenue. Fundamentals continue to be supported by business transformation/digitization trends (which are accelerating) at a reasonable valuation while much else in tech has seen substantial multiple expansion. Additionally, their valuation is supported by a 2.8% dividend yield which they easily cover. They have ~$12B in net cash on their balance sheet, or >5% of their market cap.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$CSCO.US

[category earnings ]

[tag CSCO]