Key Takeaways:

Current price: $80.9 Price target: $94

Position size: 1.43% 1 year performance: +18%

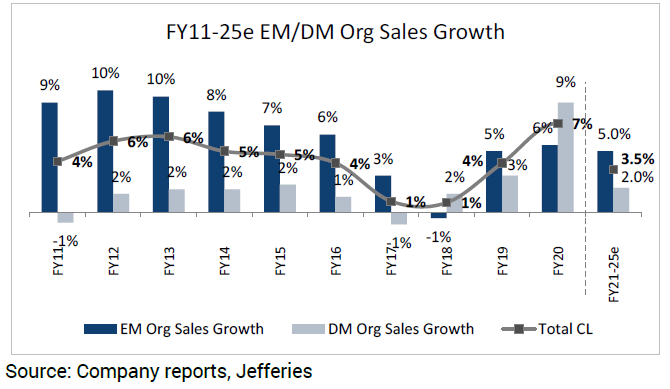

Colgate released its 1Q2021 earnings last Friday. Overall the quarter was good, but developed markets saw a faster slow down than expected, largely offset by emerging markets.

- Colgate saw a greater deceleration in its developed markets than expected (although its improved recently)

- In emerging markets, growth continues thanks to innovation in premium products (leading to price increases)

- Expect uneven recovery across geographies due to vaccine roll-out, stimulus and oil prices (higher oil prices benefits emerging markets -> higher GDP)

- Organic sales +5%, beating street expectation of +3.6%. Pricing was +4.6% and volume/mix 0.5%

- EM sales +11.5% showing continued high growth levels in those markets. Pricing helped by 6%, while volume was +5.5%

- Developed markets flat, as pantry-loading last year makes for tough comps this year, a US warehouse transition issue (resolved), and the February winter storms

- Hill’s pet nutrition +7%, good momentum thanks to increased pet ownership

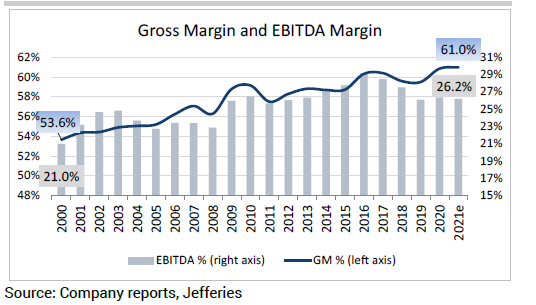

- Gross margin higher than peers, a proof of its pricing power. Should help the company offset raw material increases in quarter ahead. Operating margin down 30bps

- Input costs saw significant increases in 1Q (310bps headwind), and are expected to remain elevated in 2021

- Increased advertising

- Benefit from pricing, productivity, mix shift

- Promotion intensity gradually returning post-pandemic

- Digital advertising largely embraced by large companies, and with its higher financial ability to spend on advertising vs smaller players, should be able to regain market shares lost to small players in past years. Algorithms on online search platform tends to presents large known brands on top of search rankings, reinstating barriers to entry that were non-existent initially online, which permitted small unknown brands to gain share.

- 2021 guidance reiterated:

- Organic sales to be 3-5% (in line with its long term target)

- Gross margin expansion, and increased advertising spending

- EPS growth mid-single to high-single digits growth – but slightly lower within guidance vs. last quarter due to FX moves, increase in raw material costs and greater cautiousness about its developed markets (recent slowdown)

- Capital allocation plans: dividend, debt paydown and share repurchase increased. They see some strategic gaps they want to fill in their portfolio with M&A

- CEO quote: “we kind of experienced a perfect storm in the US in the first quarter. Obviously, the category expectations that we had declined more than we anticipated faster and deeper, quite frankly. On top of that, we obviously saw a significant increase in raw materials more than expected. Third, and this was the biggest piece versus our expectations with logistics. Two issues there. Obviously, the capacity and cost of logistics broadly across the US have gone up quite significantly. And that was exacerbated by a specific event that we had in a warehouse that we were opening up and had some transition issues associated with that,”

The Thesis on Colgate

- High exposure to fast growing emerging markets (36% of Operating Profit from Latin America; 50%+ from EM)

- Defensive Product set (soap and toothpaste). Product line less vulnerable to trade downs due to low private label exposure in the categories

- Strong balance sheet (net debt/ebitda 1.4x) and highest ROIC in the sector

- 2.64% dividend yield

$CL.US [tag CL] [category earnings]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109