WATFX Commentary – Q1 2021

Thesis

WATFX (currently yielding 1.80%) is an actively managed fund that finds overlooked areas of the market that can go against consensus views and add value. Through internal macro, credit, and fundamental research WATFX identifies undervalued securities and takes on more credit exposure to generate alpha over time. Through a diversified approach to interest rate duration, yield curve, sector allocation, and security selection, the fund dampens exposure to volatility.

[more]

Overview

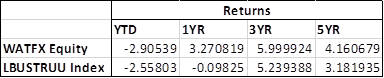

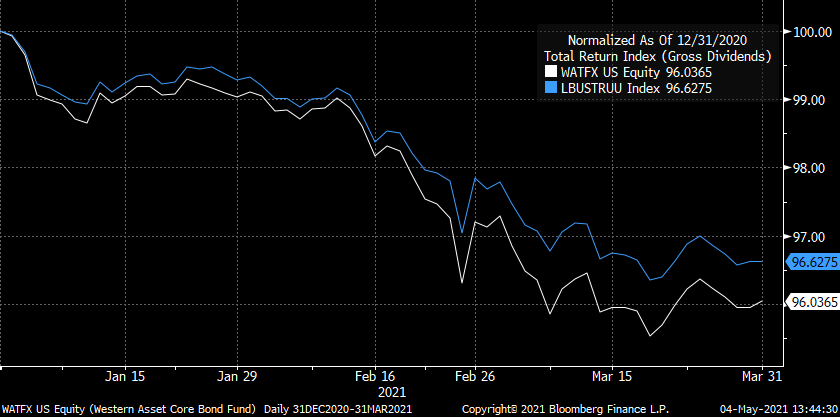

In the first quarter of 2021, WATFX underperformed the benchmark (Barclays U.S. AGG) by 58bps largely due to the fund’s duration and yield-curve positioning. US Treasury yields increased during the quarter which detracted from overall performance as the fund holds longer duration bonds compared to its benchmark. Corporate credit spreads tightened, and high-yield credit outperformed during the quarter. USD-denominated EM debt tightened while EM local rates increased – the USD strengthened compared to developed and emerging market currencies.

Q1 2021 Summary

- WATFX returned -3.95%, while the U.S. AGG returned -3.37%

- Quarter-end effective duration for WATFX was 7.17 and 6.40 for the U.S. AGG

- Continued to trim TIPS exposure as breakeven inflation rates exceeded pre-pandemic levels

- Increased allocated to agency MBS, NARMBS, and CMBS based on attractive valuations

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s diverse approach and strong top down-bottom up fundamental value investing over the long-term

- Positioned to benefit as global recovery continues, but remain diversified due to suspected long-term challenges during the recovery

- Expect spread products to outperform sovereign products as the world economy reopens, yet remain cautious around the length it may take for all markets to fully recover

- The fund expects central banks to continue to be accommodative for the foreseeable future

- The fund is excited to seek out opportunities as spreads widen and the Fed continues to support corporate credit markets

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109