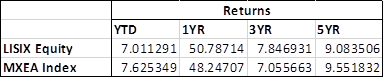

Lazard International Strategic Equity Fund Commentary – Q1 2021

Thesis

LISIX is a bottom-up, growth-based fund that completes the core satellite strategy within global equity. The fund is unique in that it focuses on individual stocks rather than markets and looks for reasonably priced companies with strong growth potential. We like LISIX because of the managers’ expertise in various market caps, geographies, and sectors which helps keep the fund diversified while providing strong upside and downside capture over time.

[more]

Overview

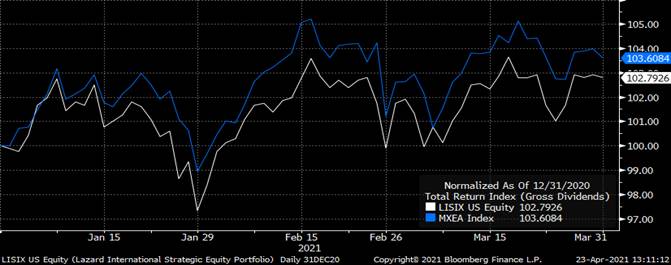

In the first quarter of 2021, LISIX underperformed the benchmark (MSCI EFEA Index) by 69bps due to the continued rebound of industries hit hardest by COVID: Energy and Financials. Communication Services and Information Technology lagged compared to these rebounding sectors, as they did not take as much of a hit during COVID’s peak in 2020. The fund continues to prefer stocks that are relatively well valued – avoiding over-valued and cheap stocks which are seeing the most return in the most recent quarter. A bias towards “quality” acted as a headwind during the quarter.

Q1 2021 Summary

- LISIX returned 2.79%, while the MSCI EAFE Index returned 3.48%

- Positives

- Volkswagen – predicting that the company will sell more EVs than Tesla

- Bankinter SA – continued revenue and overall business growth

- Suncor – recovery in oil prices and low breakeven prices

- ABB – new management focusing on ROIC and value creation

- Negatives

- Nintendo – shift away from “stay-at-home” to more traditional cyclical stocks

- Alstom – weak, but recovering margins

- Engie – transition into renewable energy

- Makita – fear of reversal for “stay-at-home” industries

- Siemens Gamesa – seasonally a weak quarter for the wind-power company

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s strong stock selection, ability to find well valued companies, and expertise in various market caps, geographies, and sectors

- Management believes the broad international universe will continue to improve as COVID-19 continues to be controlled

- Both International Developed and EM will outperform the U.S. markets due to relatively lower valuations and bottoming earnings estimates

- Less opportunity in Japan, as the country held up better throughout the heart of the pandemic

- Belief that by fall, many countries will be reopening in a significant way

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109