Current Price: $312 Target Price: $340

Position size: >2% Performance since inception: +57% (4/16/20)

Key Takeaways:

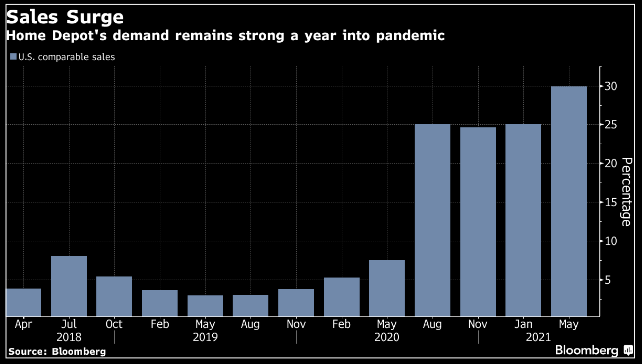

- Crushed SSS expectations w/ an incredible 31% comparable store sales increase. No doubt there are some stimulus checks being spent at HD. They continue to take share in home improvement.

- Talk of “peak growth” not concerning – they face tough SSS comparisons ahead, but multiple secular tailwinds persist.

- DIY strength continues and Pro growth is accelerating after pent-up demand from social distancing caused a delay in inside projects. They had double-digit growth with both Pro and DIY customers – “Pros continue to tell us that project demand is strong, and their backlogs are growing.”

- Omni-channel strategy continues to shine. E-Commerce sales are mid-teens % of sales and up +27% YoY, with 55% of online sales picked up in store.

- Still not giving guidance

- Mgmt. quote from call…”we’re at post-World War II housing availability, so you know, two months of supply versus historical average of six, that situation won’t be resolved in near-term. It’s going to take time for that to be resolved, so I think that supports continued growth in home values which, we know, as home values grow, people feel good about investing in their home overall. So that alone is, I think, a very positive outlook for home improvement as you move forward.”

Additional Highlights:

- Talk of “peak growth” not concerning…

- Growth rate slowing doesn’t mean the business is shrinking or that the multiple will contract. While the rate of growth (after this extraordinary year!) will clearly slow, their business will continue to grow over time. They will be lapping difficult comparisons this coming year, which could lead to some negative SSS results in the near-term. However, this commentary is really just about short-term cadence of growth and not about their long-term opportunity to continue to consolidate a fragmented market in home improvement w/ DIY & Pro, grow their more nascent MRO business (particularly after HD Supply acquisition) and leverage their best of breed omni-channel model.

- Secular tailwinds persist – rising household formation, record low inventory, higher input costs (materials & labor), stimulus = higher home prices. And higher home prices plus an aging housing stock drive remodeling spend.

- The bottom line is we need to build more homes. With the backdrop of rising household formation, demand for second homes and an aging home stock, Sam Khater, chief economist at Freddie Mac said, “We should have almost four million more housing units if we had kept up with demand the last few years. This is what you get when you under-build for 10 years.” US housing starts are at a 1.6-1.7m annual rate. Permits are running ahead of starts.

- Inventory of existing homes for sale is also at a low…two-month supply vs long-term avg of ~6 months (foreclosure moratorium is helping keep inventory low; it’s set to expire in June but could be extended again).

- Higher inflation = higher SSS = higher operating leverage: SSS had a +375bps impact from inflation driven primarily by lumber and copper. This had a negative impact on gross margins; they are passing through pricing, the negative impact was driven by mix (i.e. lumber is a relatively lower margin item). The net effect for them is growing operating profit dollars. In other words, they benefit. The negative impact of inflation would be if the higher prices started to impact overall demand, but there are no signs of that happening and long-term secular demand drivers are strong. Op margins increased by 380bps in the quarter; natural leverage on higher volumes and inflation added to that.

- What’s happening with lumber? Perfect storm of supply chain issues and higher demand…

- Demand rising as new construction and remodeling is booming aided by monetary and fiscal stimulus. Storm repairs have also been a big driver.

- Sawmill cutting capacity is the supply bottleneck & that might not improve soon – timber gets cut, transported to saw mills which produce lumber. Timber is plentiful, even oversupplied in some areas, but sawmill capacity is tight. This time last year, 40% of sawmills in N America were shut. They didn’t fully re-open until December. Sawmill capacity is still ~15% below where it was in 2006, that was the peak and was the last time this many homes were being built. There isn’t much new sawmill capacity planned, the lead time is fairly long and shortages in the necessary equipment and the labor to operate it are both a hurdle. Tight supplies and high prices could last into 2022 as storm related demand abates but general housing strength continues.

- Transportation is also feeding into higher prices.

- Wages/labor shortages – they got out ahead of wage increases, so not seeing a big impact and, overall, not having an issue finding labor. During fiscal 2020, they invested ~$2 billion on enhanced compensation and benefits for associates – they made about half of those increases permanent.

- Best of breed omni-channel model drives productivity

- By adding specialized warehouse capacity (plan to increase fulfillment sq footage by 70% this yr.) and enhancing digital capabilities (online and in the store), HD is uniquely positioned to leverage their existing retail footprint (not really growing stores) and drive steadily high ROIC that is ~45% (which is incredible).

- They dominate the category, are the low cost provider, have a relentless focus on productivity and can continue to flow an increasing amount of goods through their big box stores w/ omni-channel. This is a highly efficient model as 55% of online sales are picked up in-store which HD can fulfill from the store or nearby warehouses.

- Their express car and van delivery service that covers over 70% of the U.S. population.

· Capital allocation: they’ve resumed share repurchases and remain committed to growing their dividend over time – they increased it 10% last quarter.

· Valuation: Strong balance sheet, benefiting from strong housing trends but also has defensive qualities and a reasonable valuation, trading at ~4.4% forward FCF yield.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$HD.US

[tag HD]

[category earnings]